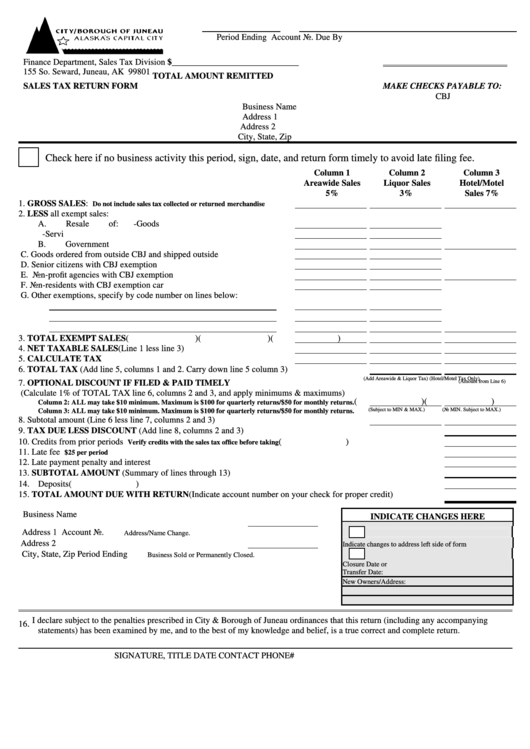

Sales Tax Return Form - City & Borough Of Juneau

ADVERTISEMENT

Period Ending

Account No.

Due By

Finance Department, Sales Tax Division

$_____________________________

155 So. Seward, Juneau, AK 99801

TOTAL AMOUNT REMITTED

SALES TAX RETURN FORM

MAKE CHECKS PAYABLE TO:

CBJ

Business Name

Address 1

Address 2

City, State, Zip

Check here if no business activity this period, sign, date, and return form timely to avoid late filing fee.

Column 1

Column 2

Column 3

Areawide Sales

Liquor Sales

Hotel/Motel

5%

3%

Sales 7%

1.

GROSS SALES:

......

Do not include sales tax collected or returned merchandise

2.

LESS all exempt sales:

A. Resale of:

-Goods...........................................................................

-Services .......................................................................

B. Government Agencies ..........................................................................

C. Goods ordered from outside CBJ and shipped outside CBJ.................

D. Senior citizens with CBJ exemption cards ...........................................

E. Non-profit agencies with CBJ exemption cards ...................................

F. Non-residents with CBJ exemption cards ............................................

G. Other exemptions, specify by code number on lines below:

.....

.....

.....

3.

TOTAL EXEMPT SALES ..................................................................... (

) (

) (

)

4.

NET TAXABLE SALES (Line 1 less line 3) ..........................................

5.

CALCULATE TAX ................................................................................

6.

TOTAL TAX (Add line 5, columns 1 and 2. Carry down line 5 column 3) ..............................

(Add Areawide & Liquor Tax)

(Hotel/Motel Tax Only)

7.

OPTIONAL DISCOUNT IF FILED & PAID TIMELY

(Amount from Line 6)

(Calculate 1% of TOTAL TAX line 6, columns 2 and 3, and apply minimums & maximums)

...... (

) (

)

Column 2: ALL may take $10 minimum. Maximum is $100 for quarterly returns/$50 for monthly returns.

......

(Subject to MIN & MAX.)

(No MIN. Subject to MAX.)

Column 3: ALL may take $10 minimum. Maximum is $100 for quarterly returns/$50 for monthly returns.

8.

Subtotal amount (Line 6 less line 7, columns 2 and 3) ...............................................................

9.

TAX DUE LESS DISCOUNT (Add line 8, columns 2 and 3) ...................................................................................

10. Credits from prior periods

...................................................................... (

)

Verify credits with the sales tax office before taking

11. Late fee

....................................................................................................................................................

$25 per period

12. Late payment penalty and interest ................................................................................................................................

13. SUBTOTAL AMOUNT (Summary of lines through 13) ...........................................................................................

14. Deposits paid ................................................................................................................................................................. (

)

15. TOTAL AMOUNT DUE WITH RETURN (Indicate account number on your check for proper credit)..................

Business Name

INDICATE CHANGES HERE

Address 1

Account No.

Address/Name Change.

Address 2

Indicate changes to address left side of form

City, State, Zip

Period Ending

Business Sold or Permanently Closed.

Closure Date or

Transfer Date:

New Owners/Address:

I declare subject to the penalties prescribed in City & Borough of Juneau ordinances that this return (including any accompanying

.

16

statements) has been examined by me, and to the best of my knowledge and belief, is a true correct and complete return.

SIGNATURE, TITLE

DATE

CONTACT PHONE#

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1