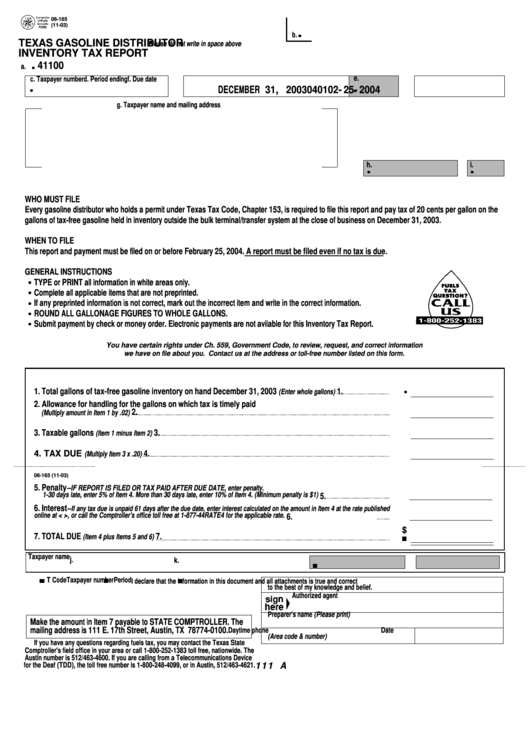

06-165

(11-03)

b.

TEXAS GASOLINE DISTRIBUTOR

Please do not write in space above

INVENTORY TAX REPORT

41100

a.

e.

c. Taxpayer number

d. Period ending

f. Due date

DECEMBER 31, 2003

0401

02-25-2004

g. Taxpayer name and mailing address

h.

i.

WHO MUST FILE

Every gasoline distributor who holds a permit under Texas Tax Code, Chapter 153, is required to file this report and pay tax of 20 cents per gallon on the

gallons of tax-free gasoline held in inventory outside the bulk terminal/transfer system at the close of business on December 31, 2003.

WHEN TO FILE

This report and payment must be filed on or before February 25, 2004. A report must be filed even if no tax is due.

GENERAL INSTRUCTIONS

TYPE or PRINT all information in white areas only.

Complete all applicable items that are not preprinted.

If any preprinted information is not correct, mark out the incorrect item and write in the correct information.

ROUND ALL GALLONAGE FIGURES TO WHOLE GALLONS.

Submit payment by check or money order. Electronic payments are not avilable for this Inventory Tax Report.

You have certain rights under Ch. 559, Government Code, to review, request, and correct information

we have on file about you. Contact us at the address or toll-free number listed on this form.

1. Total gallons of tax-free gasoline inventory on hand December 31, 2003

1.

(Enter whole gallons)

2. Allowance for handling for the gallons on which tax is timely paid

2.

(Multiply amount in Item 1 by .02)

3. Taxable gallons

3.

(Item 1 minus Item 2)

4. TAX DUE

4.

(Multiply Item 3 x .20)

06-165 (11-03)

5. Penalty

--IF REPORT IS FILED OR TAX PAID AFTER DUE DATE, enter penalty.

1-30 days late, enter 5% of Item 4. More than 30 days late, enter 10% of Item 4. (Minimum penalty is $1)

5.

6. Interest

--If any tax due is unpaid 61 days after the due date, enter interest calculated on the amount in Item 4 at the rate published

online at < , or call the Comptroller's office toll free at 1-877-44RATE4 for the applicable rate.

6.

$

7. TOTAL DUE

7.

(Item 4 plus Items 5 and 6)

Taxpayer name

j.

k.

T Code

Taxpayer number

Period

I declare that the information in this document and all attachments is true and correct

to the best of my knowledge and belief.

Authorized agent

Preparer's name (Please print)

Make the amount in Item 7 payable to STATE COMPTROLLER. The

mailing address is 111 E. 17th Street, Austin, TX 78774-0100.

Daytime phone

Date

(Area code & number)

If you have any questions regarding fuels tax, you may contact the Texas State

Comptroller's field office in your area or call 1-800-252-1383 toll free, nationwide. The

Austin number is 512/463-4600. If you are calling from a Telecommunications Device

for the Deaf (TDD), the toll free number is 1-800-248-4099, or in Austin, 512/463-4621.

111 A

1

1