Form 600rw - Register Of Wills - State Of Delaware Inventory

ADVERTISEMENT

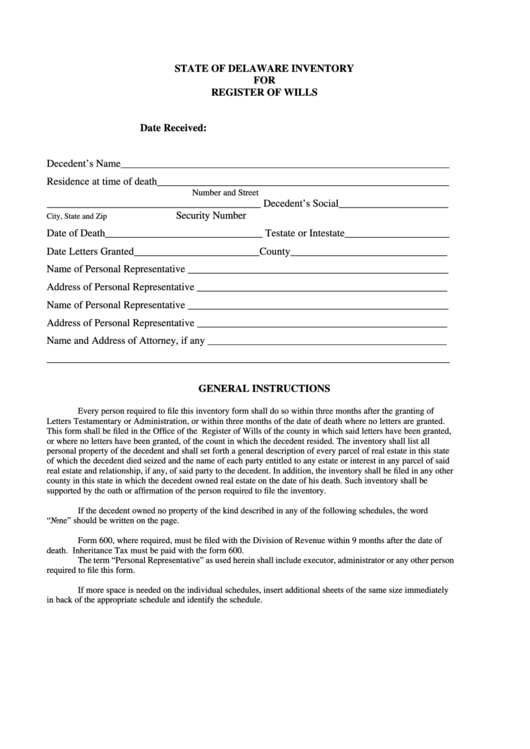

STATE OF DELAWARE INVENTORY

FOR

REGISTER OF WILLS

Date Received:

Decedent’s Name_______________________________________________________________

Residence at time of death________________________________________________________

Number and Street

_________________________________________ Decedent’s Social_____________________

Security Number

City, State and Zip

Date of Death______________________________ Testate or Intestate____________________

Date Letters Granted________________________County______________________________

Name of Personal Representative __________________________________________________

Address of Personal Representative ________________________________________________

Name of Personal Representative __________________________________________________

Address of Personal Representative ________________________________________________

Name and Address of Attorney, if any ______________________________________________

_____________________________________________________________________________

GENERAL INSTRUCTIONS

Every person required to file this inventory form shall do so within three months after the granting of

Letters Testamentary or Administration, or within three months of the date of death where no letters are granted.

This form shall be filed in the Office of the Register of Wills of the county in which said letters have been granted,

or where no letters have been granted, of the count in which the decedent resided. The inventory shall list all

personal property of the decedent and shall set forth a general description of every parcel of real estate in this state

of which the decedent died seized and the name of each party entitled to any estate or interest in any parcel of said

real estate and relationship, if any, of said party to the decedent. In addition, the inventory shall be filed in any other

county in this state in which the decedent owned real estate on the date of his death. Such inventory shall be

supported by the oath or affirmation of the person required to file the inventory.

If the decedent owned no property of the kind described in any of the following schedules, the word

“None” should be written on the page.

Form 600, where required, must be filed with the Division of Revenue within 9 months after the date of

death. Inheritance Tax must be paid with the form 600.

The term “Personal Representative” as used herein shall include executor, administrator or any other person

required to file this form.

If more space is needed on the individual schedules, insert additional sheets of the same size immediately

in back of the appropriate schedule and identify the schedule.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7