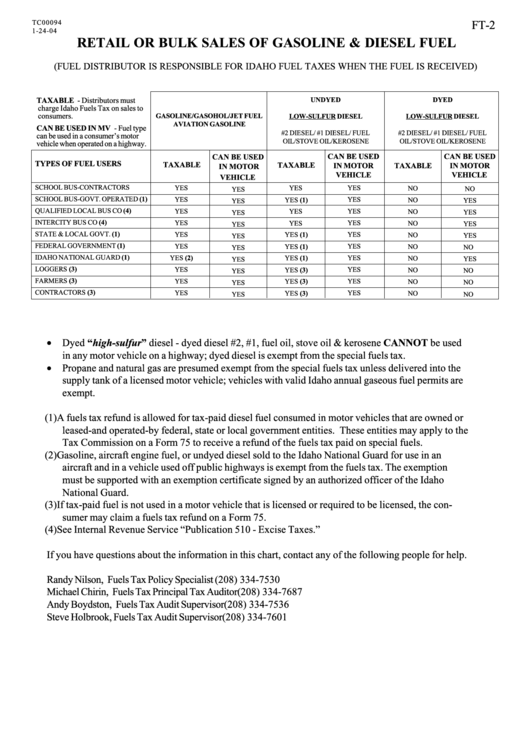

Form Ft-2-Tc00094 - Retail Or Bulk Sales Of Gasoline & Diesel Fuel

ADVERTISEMENT

TC00094

FT-2

1-24-04

RETAIL OR BULK SALES OF GASOLINE & DIESEL FUEL

(FUEL DISTRIBUTOR IS RESPONSIBLE FOR IDAHO FUEL TAXES WHEN THE FUEL IS RECEIVED)

UNDYED

DYED

TAXABLE - Distributors must

charge Idaho Fuels Tax on sales to

consumers.

GASOLINE/GASOHOL/JET FUEL

LOW-SULFUR DIESEL

LOW-SULFUR DIESEL

AVIATION GASOLINE

CAN BE USED IN MV - Fuel type

#2 DIESEL/ #1 DIESEL/ FUEL

#2 DIESEL/ #1 DIESEL/ FUEL

can be used in a consumer’s motor

OIL/STOVE OIL/KEROSENE

OIL/STOVE OIL/KEROSENE

vehicle when operated on a highway.

CAN BE USED

CAN BE USED

CAN BE USED

TYPES OF FUEL USERS

TAXABLE

TAXABLE

IN MOTOR

TAXABLE

IN MOTOR

IN MOTOR

VEHICLE

VEHICLE

VEHICLE

SCHOOL BUS-CONTRACTORS

YES

YES

YES

NO

YES

NO

SCHOOL BUS-GOVT. OPERATED (1)

YES

YES (1)

YES

NO

YES

YES

QUALIFIED LOCAL BUS CO (4)

YES

YES

YES

NO

YES

YES

INTERCITY BUS CO (4)

YES

YES

YES

NO

YES

YES

STATE & LOCAL GOVT. (1)

YES

YES (1)

YES

NO

YES

YES

FEDERAL GOVERNMENT (1)

YES

YES

YES (1)

NO

NO

YES

IDAHO NATIONAL GUARD (1)

YES (2)

YES

YES (1)

NO

YES

YES

LOGGERS (3)

YES

YES (3)

YES

NO

YES

NO

FARMERS (3)

YES

YES (3)

YES

NO

NO

YES

CONTRACTORS (3)

YES

YES

YES (3)

NO

YES

NO

• Dyed “high-sulfur” diesel - dyed diesel #2, #1, fuel oil, stove oil & kerosene CANNOT be used

in any motor vehicle on a highway; dyed diesel is exempt from the special fuels tax.

• Propane and natural gas are presumed exempt from the special fuels tax unless delivered into the

supply tank of a licensed motor vehicle; vehicles with valid Idaho annual gaseous fuel permits are

exempt.

(1) A fuels tax refund is allowed for tax-paid diesel fuel consumed in motor vehicles that are owned or

leased-and operated-by federal, state or local government entities. These entities may apply to the

Tax Commission on a Form 75 to receive a refund of the fuels tax paid on special fuels.

(2) Gasoline, aircraft engine fuel, or undyed diesel sold to the Idaho National Guard for use in an

aircraft and in a vehicle used off public highways is exempt from the fuels tax. The exemption

must be supported with an exemption certificate signed by an authorized officer of the Idaho

National Guard.

(3) If tax-paid fuel is not used in a motor vehicle that is licensed or required to be licensed, the con-

sumer may claim a fuels tax refund on a Form 75.

(4) See Internal Revenue Service “Publication 510 - Excise Taxes.”

If you have questions about the information in this chart, contact any of the following people for help.

Randy Nilson, Fuels Tax Policy Specialist ......................................................................... (208) 334-7530

Michael Chirin, Fuels Tax Principal Tax Auditor ................................................................ (208) 334-7687

Andy Boydston, Fuels Tax Audit Supervisor ..................................................................... (208) 334-7536

Steve Holbrook, Fuels Tax Audit Supervisor ..................................................................... (208) 334-7601

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1