Form Tr-100 - Video Gaming Report March 2004

ADVERTISEMENT

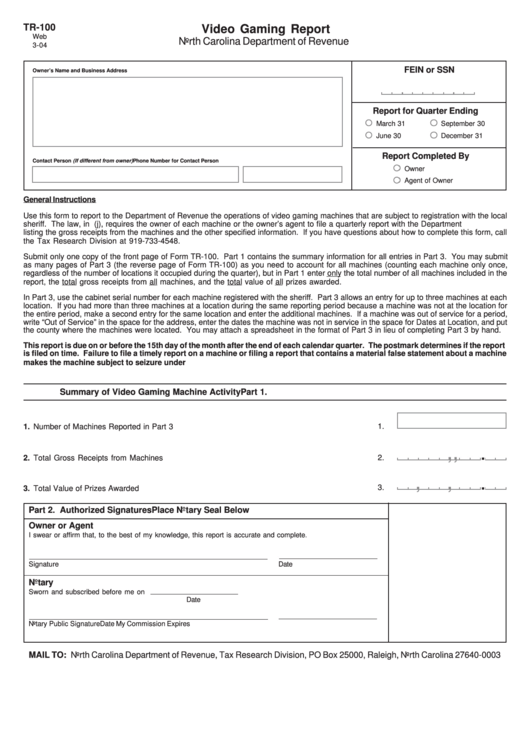

TR-100

Video Gaming Report

Web

North Carolina Department of Revenue

3-04

FEIN or SSN

Owner’s Name and Business Address

Report for Quarter Ending

March 31

September 30

June 30

December 31

Report Completed By

Contact Person (If different from owner)

Phone Number for Contact Person

Owner

Agent of Owner

General Instructions

Use this form to report to the Department of Revenue the operations of video gaming machines that are subject to registration with the local

sheriff. The law, in G.S. 14-306.1(j), requires the owner of each machine or the owner’s agent to file a quarterly report with the Department

listing the gross receipts from the machines and the other specified information. If you have questions about how to complete this form, call

the Tax Research Division at 919-733-4548.

Submit only one copy of the front page of Form TR-100. Part 1 contains the summary information for all entries in Part 3. You may submit

as many pages of Part 3 (the reverse page of Form TR-100) as you need to account for all machines (counting each machine only once,

regardless of the number of locations it occupied during the quarter), but in Part 1 enter only the total number of all machines included in the

report, the total gross receipts from all machines, and the total value of all prizes awarded.

In Part 3, use the cabinet serial number for each machine registered with the sheriff. Part 3 allows an entry for up to three machines at each

location. If you had more than three machines at a location during the same reporting period because a machine was not at the location for

the entire period, make a second entry for the same location and enter the additional machines. If a machine was out of service for a period,

write “Out of Service” in the space for the address, enter the dates the machine was not in service in the space for Dates at Location, and put

the county where the machines were located. You may attach a spreadsheet in the format of Part 3 in lieu of completing Part 3 by hand.

This report is due on or before the 15th day of the month after the end of each calendar quarter. The postmark determines if the report

is filed on time. Failure to file a timely report on a machine or filing a report that contains a material false statement about a machine

makes the machine subject to seizure under G.S. 14-298.

Part 1.

Summary of Video Gaming Machine Activity

1.

1. Number of Machines Reported in Part 3

,

,

.

2.

2. Total Gross Receipts from Machines

,

,

.

3.

3. Total Value of Prizes Awarded

Part 2. Authorized Signatures

Place Notary Seal Below

Owner or Agent

I swear or affirm that, to the best of my knowledge, this report is accurate and complete.

Signature

Date

Notary

Sworn and subscribed before me on

Date

Notary Public Signature

Date My Commission Expires

MAIL TO: North Carolina Department of Revenue, Tax Research Division, PO Box 25000, Raleigh, North Carolina 27640-0003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2