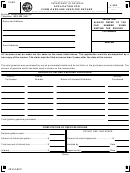

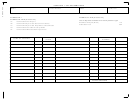

Form L-2195 - Motor Fuel Manufacturers Monthly User Fee And Fee Calculation Page 2

ADVERTISEMENT

ADJUSTMENTS

BIODIESEL (B100)

SUBSTITUTE FUELS

1.

BEGINNING INVENTORY (Gallons on hand at the beginning of the month)

2.

TOTAL GALLONS MANUFACTURED IN SOUTH CAROLINA

3.

TOTAL GALLONS SOLD IN SOUTH CAROLINA (USER FEE COLLECTED)

EXPORTS

4.

SCH 1

GALLONS SOLD FOR EXPORT

EXEMPT SALES

5.

GALLONS EXEMPT FOR US GOVERNMENT SALES

SCH 1

6.

GALLONS EXEMPT FOR SC DEPT OF EDUC SCHOOL BUSES

SCH 1

7.

GALLONS EXEMPT FOR OTHER EXEMPT SALES

SCH 1

8.

TOTAL EXEMPT GALLONS (Line 5 + Line 6 +Line 7)

CALC

9.

GALLONS SOLD BLENDED WITH DYED FUELS

SCH 1

10.

TOTAL GALLONS EXEMPT FROM STATE USER FEE (Line 8 + Line 9)

CALC

11.

ENDING INVENTORY (Gallons on hand at the end of the month)

GALLONS MANUFACTURED SUBJECT TO USER FEES

BIODIESEL (B100)

SUBSTITUTE FUELS

12.

TOTAL GALLONS MANUFACTURED SUBJECT TO USER FEE (Line 2 - Line 4 - Line 10)

CALC

TOTAL GALLONS MANUFACTURED SUBJECT TO INSPECTION & ENVIRONMENTAL FEES

13.

(Line 2 - Line 4)

CALC

Penalties - Failure to file a return will result in a penalty of five per cent (5%) for the first month plus five percent (5%) for each additional month not to exceed a total of

twenty-five percent (25%). Failure to pay will result in penalties of one half of one percent (.5%) per month not to exceed twenty-five (25%). Other penalties may apply.

Interest - Interest on all overdue accounts will be assessed at the rate provided under Section 6621 and 6622 of the Internal Revenue Code. Rates will change quarterly

depending on the prime rate. In addition, interest will be compounded daily.

Name: _______________________ Signature: ___________________________Phone No: ________________ Date: ______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6