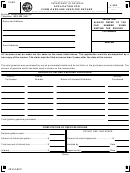

Form L-2195 - Motor Fuel Manufacturers Monthly User Fee And Fee Calculation Page 3

ADVERTISEMENT

INSTRUCTIONS FOR L-2195 MANUFACTURERS MONTHLY USER FEE

AND OTHER APPLICABLE FEE CALCULATION

Due Date - A report should be filed for each month and is due on the 22nd day of the month.

GENERAL INFORMATION

A. This report is required to be filed when Biodiesel (B100) is manufactured in South Carolina.

B. A REPORT MUST BE FILED EVEN IF NO PRODUCT WAS MANUFACTURED DURING THE MONTH.

Failure to file a report will result in an assessment of a delinquent penalty not to exceed $500.00.

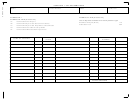

Line 1 - Total Gallons Biodiesel (B100)

List the total number of gallons of Biodiesel (B100) manufactured in South Carolina subject to the user fee from line

12 of the calculation page.

Line 2 - Total Gallons Substitute Fuels

List the total number of gallons of Substitute fuels manufactured in South Carolina subject to the User fee from line 12

of the calculation page.

Line 3 - Total gallons Manufactured

Add Line 1 + Line 2 for the total gallons manufactured in South Carolina subject to the user fee.

Line 4 - Net User Fee Due

Multiply Line 3 by $.16 to calculate the net user fee due.

Lines 5, 9, 13 - Penalty

Failure to file a return will result in a penalty of five percent (5%) for the first month plus five percent (5%) for each

additional month not to exceed a total of twenty-five percent (25%). Failure to pay will result in penalties of one half of

one percent (.5%) per month not to exceed twenty-five percent (25%). Other penalties may apply.

Lines 6, 10, 14 - Interest

Interest on all overdue accounts will be assessed at the rate provided under Section 6621 and 6622 of the Internal

Revenue Code. Rates will change quarterly depending on the prime rate. In addition, interest will be compounded

daily.

Lines 8 and 12 - Other Applicable Fees

Line 8 - multiply Line 13 of the calculation page by $.0025 to calculate the inspection fee due.

Line 12 - multiply Line 13 of the calculation page by $.0050 to calculate the environmental impact fee due.

Lines 7, 11, 15 - Totals Due

Add any penalty (Lines 5, 9, and 13), and interest due (Lines 6, 10, and 14) to the user fee and other applicable fees

calculated (Lines 7, 11, and 15) and enter the total user fee/other applicable fees plus penalty and interest.

Line 16 - Total User Fee and Other Applicable Fees Due

Add the total due lines together (Line 7, 11, and 15) to calculate the total payment to be made with the Manufacturers

User Fee and Fee calculation return.

MAIL TO: Make the check payable to the South Carolina Department of Revenue and mail to South Carolina Department

of Revenue, Motor Fuel Reports, Columbia, SC 29214-0132.

If you have any questions or need assistance calculating penalty and interest, please call this office at (803) 896-1990.

43513027

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6