Clear form

Print Form

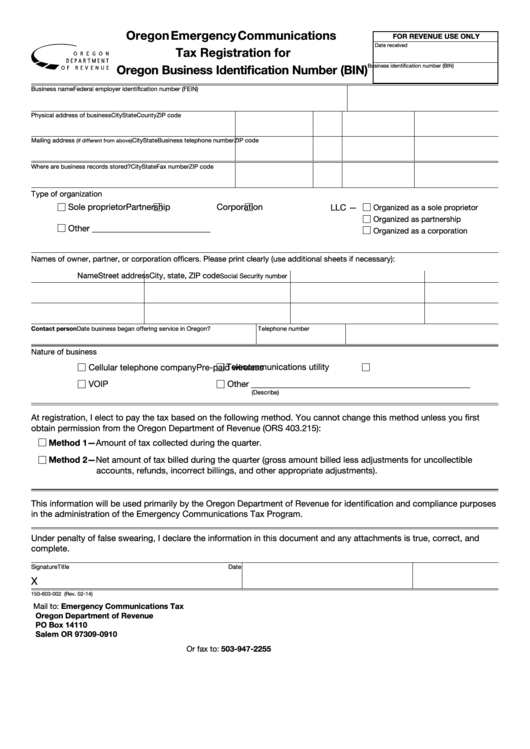

Oregon Emergency Communications

FOR REVENUE USE ONLY

Date received

Tax Registration for

Oregon Business Identification Number (BIN)

Business identification number (BIN)

Business name

Federal employer identification number (FEIN)

Physical address of business

City

State

ZIP code

County

Mailing address

City

State

ZIP code

Business telephone number

(if different from above)

Where are business records stored?

City

State

ZIP code

Fax number

Type of organization

Sole proprietor

Partnership

Corporation

LLC —

Organized as a sole proprietor

Organized as partnership

Other ___________________________

Organized as a corporation

Names of owner, partner, or corporation officers. Please print clearly (use additional sheets if necessary):

Name

Street address

City, state, ZIP code

Social Security number

Contact person

Telephone number

Date business began offering service in Oregon?

Nature of business

Telecommunications utility

Cellular telephone company

Pre-paid wireless

VOIP

Other __________________________________________________

(Describe)

At registration, I elect to pay the tax based on the following method. You cannot change this method unless you first

obtain permission from the Oregon Department of Revenue (ORS 403.215):

Method 1—Amount of tax collected during the quarter.

Method 2—Net amount of tax billed during the quarter (gross amount billed less adjustments for uncollectible

accounts, refunds, incorrect billings, and other appropriate adjustments).

This information will be used primarily by the Oregon Department of Revenue for identification and compliance purposes

in the administration of the Emergency Communications Tax Program.

Under penalty of false swearing, I declare the information in this document and any attachments is true, correct, and

complete.

Signature

Title

Date

X

150-603-002 (Rev. 02-14)

Mail to: Emergency Communications Tax

Oregon Department of Revenue

PO Box 14110

Salem OR 97309-0910

Or fax to: 503-947-2255

1

1