Form Ouf-1 - Instructions

ADVERTISEMENT

O H I O

U N C L A I M E D

F U N D S

2 0 0 0

A N N U A L

H O L D E R

R E P O R T

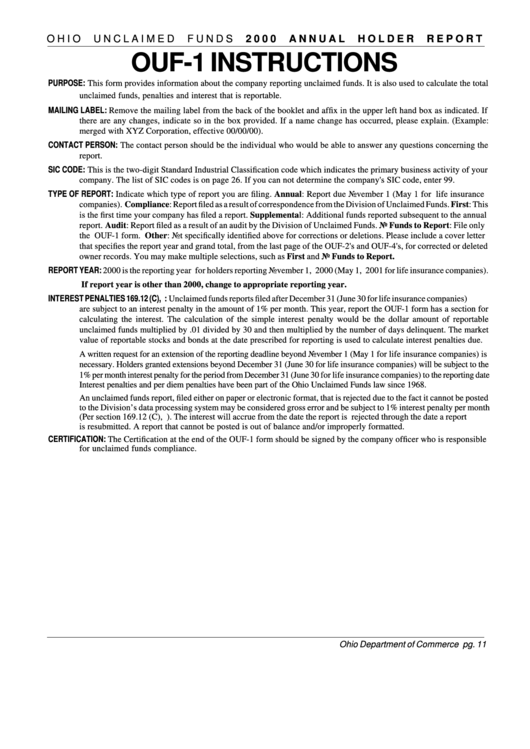

OUF-1 INSTRUCTIONS

PURPOSE: This form provides information about the company reporting unclaimed funds. It is also used to calculate the total

unclaimed funds, penalties and interest that is reportable.

MAILING LABEL: Remove the mailing label from the back of the booklet and affix in the upper left hand box as indicated. If

there are any changes, indicate so in the box provided. If a name change has occurred, please explain. (Example:

merged with XYZ Corporation, effective 00/00/00).

CONTACT PERSON: The contact person should be the individual who would be able to answer any questions concerning the

report.

SIC CODE: This is the two-digit Standard Industrial Classification code which indicates the primary business activity of your

company. The list of SIC codes is on page 26. If you can not determine the company's SIC code, enter 99.

TYPE OF REPORT: Indicate which type of report you are filing. Annual: Report due November 1 (May 1 for life insurance

companies). Compliance: Report filed as a result of correspondence from the Division of Unclaimed Funds. First: This

is the first time your company has filed a report. Supplemental: Additional funds reported subsequent to the annual

report. Audit: Report filed as a result of an audit by the Division of Unclaimed Funds. No Funds to Report: File only

the OUF-1 form. Other: Not specifically identified above for corrections or deletions. Please include a cover letter

that specifies the report year and grand total, from the last page of the OUF-2's and OUF-4's, for corrected or deleted

owner records. You may make multiple selections, such as First and No Funds to Report.

REPORT YEAR: 2000 is the reporting year for holders reporting November 1, 2000 (May 1, 2001 for life insurance companies).

If report year is other than 2000, change to appropriate reporting year.

INTEREST PENALTIES 169.12 (C), O.R.C.: Unclaimed funds reports filed after December 31 (June 30 for life insurance companies)

are subject to an interest penalty in the amount of 1% per month. This year, report the OUF-1 form has a section for

calculating the interest. The calculation of the simple interest penalty would be the dollar amount of reportable

unclaimed funds multiplied by .01 divided by 30 and then multiplied by the number of days delinquent. The market

value of reportable stocks and bonds at the date prescribed for reporting is used to calculate interest penalties due.

A written request for an extension of the reporting deadline beyond November 1 (May 1 for life insurance companies) is

necessary. Holders granted extensions beyond December 31 (June 30 for life insurance companies) will be subject to the

1% per month interest penalty for the period from December 31 (June 30 for life insurance companies) to the reporting date

Interest penalties and per diem penalties have been part of the Ohio Unclaimed Funds law since 1968.

An unclaimed funds report, filed either on paper or electronic format, that is rejected due to the fact it cannot be posted

to the Division’s data processing system may be considered gross error and be subject to 1% interest penalty per month

(Per section 169.12 (C), O.R.C.). The interest will accrue from the date the report is rejected through the date a report

is resubmitted. A report that cannot be posted is out of balance and/or improperly formatted.

CERTIFICATION: The Certification at the end of the OUF-1 form should be signed by the company officer who is responsible

for unclaimed funds compliance.

Ohio Department of Commerce pg. 11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1