Form Ct-641 - Manufacturer'S Real Property Tax Credit 2014

ADVERTISEMENT

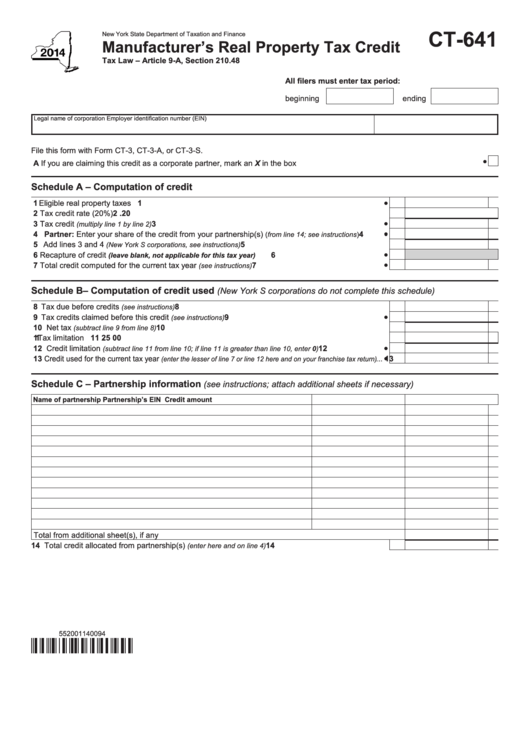

CT-641

New York State Department of Taxation and Finance

Manufacturer’s Real Property Tax Credit

Tax Law – Article 9-A, Section 210.48

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number (EIN)

File this form with Form CT-3, CT-3-A, or CT-3-S.

A If you are claiming this credit as a corporate partner, mark an X in the box ...................................................................................

Schedule A – Computation of credit

1 Eligible real property taxes ................................................................................................................

1

2 Tax credit rate (20%) ............................................................................................................................

2

.20

3 Tax credit

.........................................................................................................

3

(multiply line 1 by line 2)

4 Partner: Enter your share of the credit from your partnership(s)

..........

4

(from line 14; see instructions)

5 Add lines 3 and 4

....................................................................

5

(New York S corporations, see instructions)

6 Recapture of credit

.........................................................

6

(leave blank, not applicable for this tax year)

7 Total credit computed for the current tax year

7

...........................................................

(see instructions)

Schedule B – Computation of credit used

(New York S corporations do not complete this schedule)

8 Tax due before credits

.................................................................................................

8

(see instructions)

9 Tax credits claimed before this credit

........................................................................

9

(see instructions)

10 Net tax

........................................................................................................... 10

(subtract line 9 from line 8)

11 Tax limitation ........................................................................................................................................ 11

25 00

12 Credit limitation

...............................

12

(subtract line 11 from line 10; if line 11 is greater than line 10, enter 0)

13 Credit used for the current tax year

...

13

(enter the lesser of line 7 or line 12 here and on your franchise tax return)

Schedule C – Partnership information

(see instructions; attach additional sheets if necessary)

Name of partnership

Partnership’s EIN

Credit amount

Total from additional sheet(s), if any.................................................................................................................

14 Total credit allocated from partnership(s)

....................................................... 14

(enter here and on line 4)

552001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2