Arizona Form 800nr - Cigarette Distributor'S Monthly Return For Nonresident Licensed Distributors - Arizona Department Of Revenue Page 5

ADVERTISEMENT

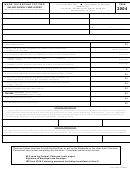

AZ FORM 800NR

Nonresident Distributor’s Certifi cation of No Nonparticipating Manufacturer’s Activity

(In Lieu of Nonparticipating Manufacturer’s Schedules)

LEGAL BUSINESS NAME/DBA NAME

TOBACCO LICENSE NO.

FOR THE MONTH OF

, 20____

As evidenced by my signature below, I __________________________________, do hereby certify

(print name)

M M D D Y Y Y Y

M M D D Y Y Y Y

under penalty of perjury, that during the period of

through

,

the distributor named above:

DID NOT pay state excise taxes on any nonparticipating manufacturer’s roll-your-own

1

tobacco required to be reported on Schedule A-4 of Form 819NR. If not checked, I

have engaged in this activity and have completed and submitted Schedule A-4 with

Form 819NR.

DID NOT affi x the excise tax stamp of the State of Arizona to or otherwise pay state

2

excise taxes for any nonparticipating manufacturer’s cigarettes required to be reported on

Schedule A-4 of Form 800NR. If not checked, I have engaged in this activity and have

completed and submitted Schedule A-4 with Form 800NR.

SIGNATURE: (Must be signed to be considered complete.)

TAXPAYER’S AUTHORIZED AGENT’S SIGNATURE

TITLE

DATE

Page 5 of 7

ADOR 14-2013 (8/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7