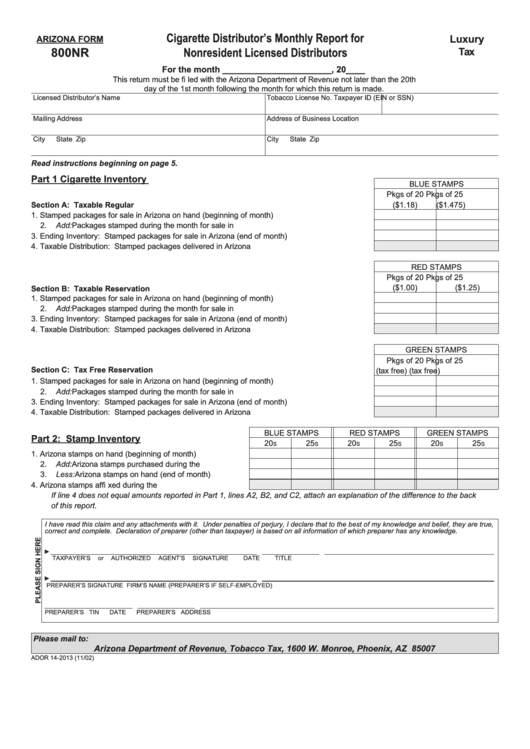

Luxury

Cigarette Distributor’s Monthly Report for

ARIZONA FORM

800NR

Tax

Nonresident Licensed Distributors

For the month _______________________, 20____

This return must be fi led with the Arizona Department of Revenue not later than the 20th

day of the 1st month following the month for which this return is made.

Licensed Distributor’s Name

Tobacco License No.

Taxpayer ID (EIN or SSN)

Mailing Address

Address of Business Location

City

State

Zip

City

State

Zip

Read instructions beginning on page 5.

Part 1 Cigarette Inventory

BLUE STAMPS

Pkgs of 20

Pkgs of 25

Section A: Taxable Regular

($1.18)

($1.475)

1. Stamped packages for sale in Arizona on hand (beginning of month) ..................................

2. Add: Packages stamped during the month for sale in Arizona .............................................

3. Ending Inventory: Stamped packages for sale in Arizona (end of month) ............................

4. Taxable Distribution: Stamped packages delivered in Arizona .............................................

RED STAMPS

Pkgs of 20

Pkgs of 25

Section B: Taxable Reservation

($1.00)

($1.25)

1. Stamped packages for sale in Arizona on hand (beginning of month) ..................................

2. Add: Packages stamped during the month for sale in Arizona .............................................

3. Ending Inventory: Stamped packages for sale in Arizona (end of month) ............................

4. Taxable Distribution: Stamped packages delivered in Arizona .............................................

GREEN STAMPS

Pkgs of 20

Pkgs of 25

Section C: Tax Free Reservation

(tax free)

(tax free)

1. Stamped packages for sale in Arizona on hand (beginning of month) ..................................

2. Add: Packages stamped during the month for sale in Arizona .............................................

3. Ending Inventory: Stamped packages for sale in Arizona (end of month) ............................

4. Taxable Distribution: Stamped packages delivered in Arizona .............................................

BLUE STAMPS

RED STAMPS

GREEN STAMPS

Part 2: Stamp Inventory

20

25

20

25

20

25

S

S

S

S

S

S

1. Arizona stamps on hand (beginning of month) ............

2. Add: Arizona stamps purchased during the month .....

3. Less: Arizona stamps on hand (end of month) ...........

4. Arizona stamps affi xed during the month.....................

If line 4 does not equal amounts reported in Part 1, lines A2, B2, and C2, attach an explanation of the difference to the back

of this report.

I have read this claim and any attachments with it. Under penalties of perjury, I declare that to the best of my knowledge and belief, they are true,

correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

►

TAXPAYER’S or AUTHORIZED AGENT’S SIGNATURE

DATE

TITLE

►

PREPARER’S SIGNATURE

FIRM’S NAME (PREPARER’S IF SELF-EMPLOYED)

PREPARER’S TIN

DATE

PREPARER’S ADDRESS

Please mail to:

Arizona Department of Revenue, Tobacco Tax, 1600 W. Monroe, Phoenix, AZ 85007

ADOR 14-2013 (11/02)

1

1 2

2 3

3 4

4 5

5