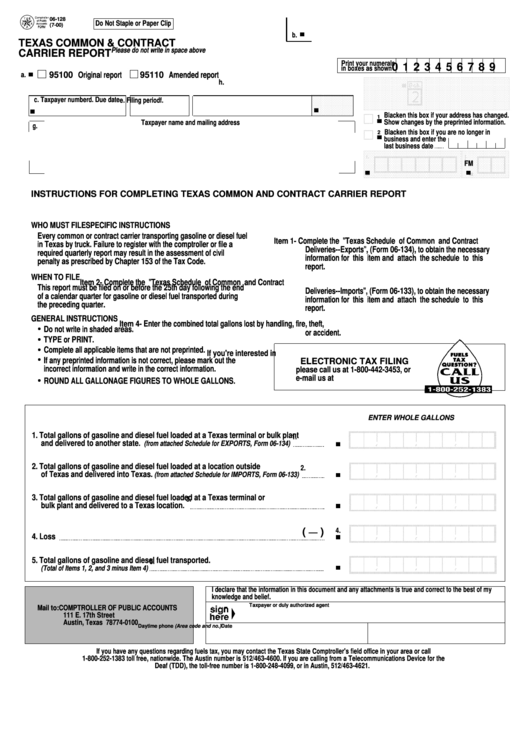

06-128

Do Not Staple or Paper Clip

(7-00)

b.

TEXAS COMMON & CONTRACT

Please do not write in space above

CARRIER REPORT

0123456789

Print your numerals

in boxes as shown

95100 Original report

95110 Amended report

a.

h.

c. Taxpayer number

d. Due date

e. Filing period

f.

Blacken this box if your address has changed.

1

Show changes by the preprinted information.

Taxpayer name and mailing address

g.

Blacken this box if you are no longer in

2

business and enter the

last business date

i.

j.

FM

INSTRUCTIONS FOR COMPLETING TEXAS COMMON AND CONTRACT CARRIER REPORT

WHO MUST FILE

SPECIFIC INSTRUCTIONS

Every common or contract carrier transporting gasoline or diesel fuel

Item 1- Complete the "Texas Schedule of Common and Contract

in Texas by truck. Failure to register with the comptroller or file a

Deliveries--Exports", (Form 06-134), to obtain the necessary

required quarterly report may result in the assessment of civil

information for this item and attach the schedule to this

penalty as prescribed by Chapter 153 of the Tax Code.

report.

WHEN TO FILE

Item 2- Complete the "Texas Schedule of Common and Contract

This report must be filed on or before the 25th day following the end

Deliveries--Imports", (Form 06-133), to obtain the necessary

of a calendar quarter for gasoline or diesel fuel transported during

information for this item and attach the schedule to this

the preceding quarter.

report.

GENERAL INSTRUCTIONS

Item 4- Enter the combined total gallons lost by handling, fire, theft,

Do not write in shaded areas.

or accident.

TYPE or PRINT.

Complete all applicable items that are not preprinted.

If you're interested in

If any preprinted information is not correct, please mark out the

ELECTRONIC TAX FILING

incorrect information and write in the correct information.

please call us at 1-800-442-3453, or

e-mail us at etf.cpa@cpa.state.tx.us

ROUND ALL GALLONAGE FIGURES TO WHOLE GALLONS.

ENTER WHOLE GALLONS

1. Total gallons of gasoline and diesel fuel loaded at a Texas terminal or bulk plant

1.

and delivered to another state.

(from attached Schedule for EXPORTS, Form 06-134)

2. Total gallons of gasoline and diesel fuel loaded at a location outside

2.

of Texas and delivered into Texas.

(from attached Schedule for IMPORTS, Form 06-133)

3. Total gallons of gasoline and diesel fuel loaded at a Texas terminal or

3.

bulk plant and delivered to a Texas location.

(

)

4.

4. Loss

5. Total gallons of gasoline and diesel fuel transported.

5.

(Total of Items 1, 2, and 3 minus Item 4)

I declare that the information in this document and any attachments is true and correct to the best of my

knowledge and belief.

Taxpayer or duly authorized agent

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

111 E. 17th Street

Austin, Texas 78774-0100

Daytime phone (Area code and no.)

Date

If you have any questions regarding fuels tax, you may contact the Texas State Comptroller's field office in your area or call

1-800-252-1383 toll free, nationwide. The Austin number is 512/463-4600. If you are calling from a Telecommunications Device for the

Deaf (TDD), the toll-free number is 1-800-248-4099, or in Austin, 512/463-4621.

1

1