Form 211 - Irs Fraud Report Form

Download a blank fillable Form 211 - Irs Fraud Report Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 211 - Irs Fraud Report Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

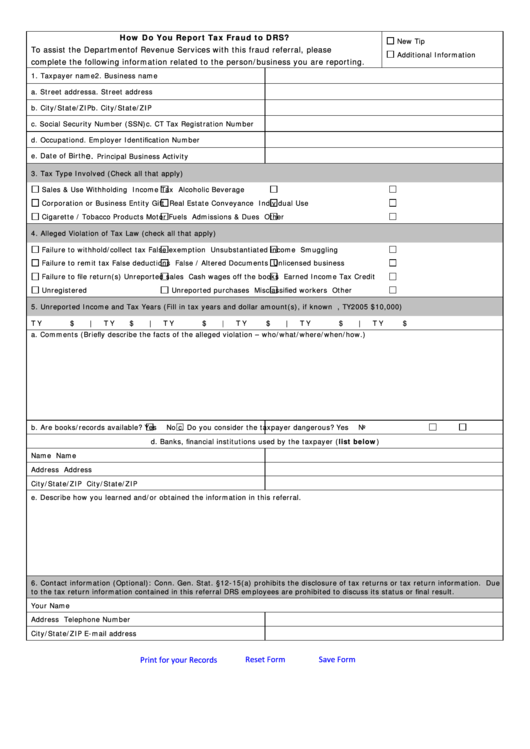

How Do You Report Tax Fraud to DRS?

New Tip

To assist the Department of Revenue Services with this fraud referral, please

Additional Information

complete the following information related to the person/business you are reporting.

1. Taxpayer name

2. Business name

a. Street address

a. Street address

b. City/State/ZIP

b. City/State/ZIP

c. Social Security Number (SSN)

c. CT Tax Registration Number

d. Occupation

d. Employer Identification Number

e.

e. Date of Birth

Principal Business Activity

3. Tax Type Involved (Check all that apply)

Sales & Use

Withholding

Income Tax

Alcoholic Beverage

Corporation or Business Entity

Gift

Real Estate Conveyance

Individual Use

Cigarette / Tobacco Products

Motor Fuels

Admissions & Dues

Other

4. Alleged Violation of Tax Law (check all that apply)

Failure to withhold/collect tax

False exemption

Unsubstantiated income

Smuggling

Failure to remit tax

False deductions

False / Altered Documents

Unlicensed business

Failure to file return(s)

Unreported sales

Cash wages off the books

Earned Income Tax Credit

Unregistered

Unreported purchases

Misclassified workers

Other

5. Unreported Income and Tax Years (Fill in tax years and dollar amount(s), if known e.g., TY2005 $10,000)

TY

$

| TY

$

| TY

$

| TY

$

| TY

$

| TY

$

a. Comments (Briefly describe the facts of the alleged violation – who/what/where/when/how.)

b. Are books/records available?

Yes

No

c. Do you consider the taxpayer dangerous?

Yes

No

d. Banks, financial institutions used by the taxpayer (list below)

Name

Name

Address

Address

City/State/ZIP

City/State/ZIP

e. Describe how you learned and/or obtained the information in this referral.

6. Contact information (Optional): Conn. Gen. Stat. §12-15(a) prohibits the disclosure of tax returns or tax return information. Due

to the tax return information contained in this referral DRS employees are prohibited to discuss its status or final result.

Your Name

Address

Telephone Number

City/State/ZIP

E-mail address

Reset Form

Save Form

Print for your Records

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1