Form Tmt-334 - Application For Highway Use And/or Automotive Fuel Carrier Replacement Permits And/or Stickers - New York State Department Of Taxation And Finance

ADVERTISEMENT

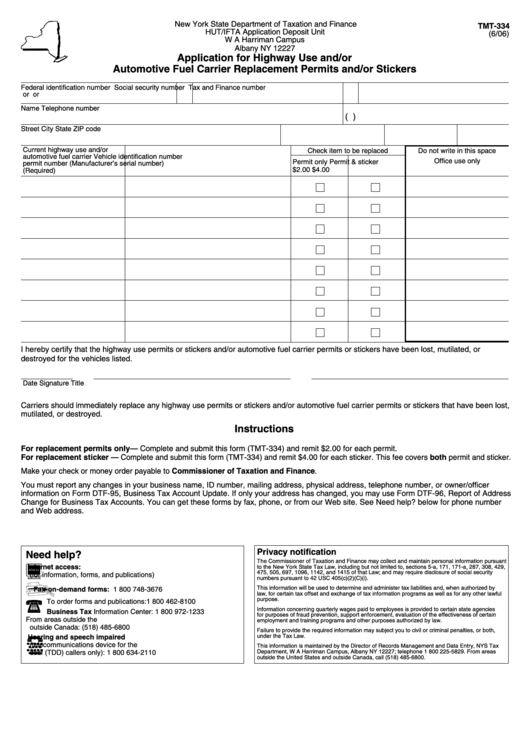

New York State Department of Taxation and Finance

TMT-334

HUT/IFTA Application Deposit Unit

(6/06)

W A Harriman Campus

Albany NY 12227

Application for Highway Use and/or

Automotive Fuel Carrier Replacement Permits and/or Stickers

Federal identification number

Social security number

Tax and Finance number

or

or

Name

Telephone number

(

)

Street

City

State

ZIP code

Current highway use and/or

Check item to be replaced

Do not write in this space

automotive fuel carrier

Vehicle identification number

Office use only

Permit only

Permit & sticker

permit number

(Manufacturer’s serial number)

$2.00

$4.00

(Required)

I hereby certify that the highway use permits or stickers and/or automotive fuel carrier permits or stickers have been lost, mutilated, or

destroyed for the vehicles listed.

Date

Signature

Title

Carriers should immediately replace any highway use permits or stickers and/or automotive fuel carrier permits or stickers that have been lost,

mutilated, or destroyed.

Instructions

For replacement permits only — Complete and submit this form (TMT-334) and remit $2.00 for each permit.

For replacement sticker — Complete and submit this form (TMT-334) and remit $4.00 for each sticker. This fee covers both permit and sticker.

Make your check or money order payable to Commissioner of Taxation and Finance.

You must report any changes in your business name, ID number, mailing address, physical address, telephone number, or owner/officer

information on Form DTF-95, Business Tax Account Update. If only your address has changed, you may use Form DTF-96, Report of Address

Change for Business Tax Accounts. You can get these forms by fax, phone, or from our Web site. See Need help? below for phone number

and Web address.

Privacy notification

Need help?

The Commissioner of Taxation and Finance may collect and maintain personal information pursuant

Internet access:

to the New York State Tax Law, including but not limited to, sections 5-a, 171, 171-a, 287, 308, 429,

475, 505, 697, 1096, 1142, and 1415 of that Law; and may require disclosure of social security

(for information, forms, and publications)

numbers pursuant to 42 USC 405(c)(2)(C)(i).

Fax-on-demand forms:

This information will be used to determine and administer tax liabilities and, when authorized by

1 800 748-3676

law, for certain tax offset and exchange of tax information programs as well as for any other lawful

purpose.

To order forms and publications:

1 800 462-8100

Information concerning quarterly wages paid to employees is provided to certain state agencies

Business Tax Information Center:

1 800 972-1233

for purposes of fraud prevention, support enforcement, evaluation of the effectiveness of certain

From areas outside the U.S. and

employment and training programs and other purposes authorized by law.

outside Canada:

(518) 485-6800

Failure to provide the required information may subject you to civil or criminal penalties, or both,

Hearing and speech impaired

under the Tax Law.

(telecommunications device for the

This information is maintained by the Director of Records Management and Data Entry, NYS Tax

deaf (TDD) callers only):

1 800 634-2110

Department, W A Harriman Campus, Albany NY 12227; telephone 1 800 225-5829. From areas

outside the United States and outside Canada, call (518) 485-6800.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1