Form Dtf-1004 - Instructions

ADVERTISEMENT

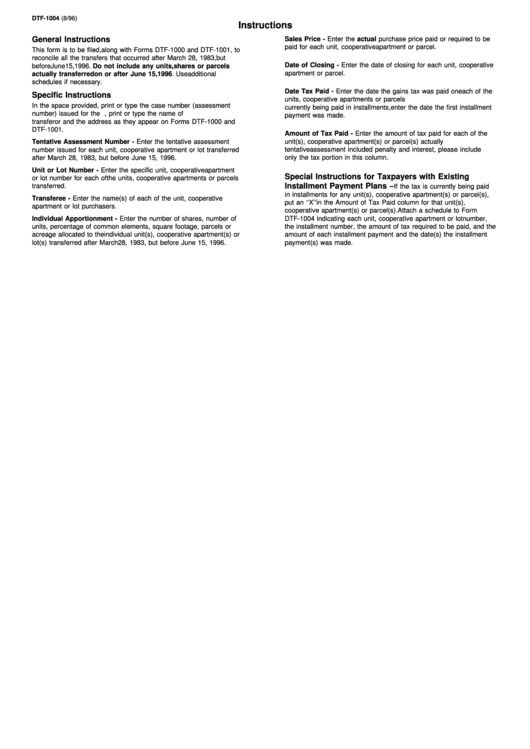

DTF-1004 (8/96)

Instructions

General Instructions

Sales Price - Enter the actual purchase price paid or required to be

paid for each unit, cooperative apartment or parcel.

This form is to be filed, along with Forms DTF-1000 and DTF-1001, to

reconcile all the transfers that occurred after March 28, 1983, but

Date of Closing - Enter the date of closing for each unit, cooperative

before June 15, 1996. Do not include any units, shares or parcels

apartment or parcel.

actually transferred on or after June 15, 1996. Use additional

schedules if necessary.

Date Tax Paid - Enter the date the gains tax was paid on each of the

Specific Instructions

units, cooperative apartments or parcels transferred. If the tax is

In the space provided, print or type the case number (assessment

currently being paid in installments, enter the date the first installment

number) issued for the project. In addition, print or type the name of

payment was made.

transferor and the address as they appear on Forms DTF-1000 and

DTF-1001.

Amount of Tax Paid - Enter the amount of tax paid for each of the

Tentative Assessment Number - Enter the tentative assessment

unit(s), cooperative apartment(s) or parcel(s) actually transferred. If the

number issued for each unit, cooperative apartment or lot transferred

tentative assessment included penalty and interest, please include

after March 28, 1983, but before June 15, 1996.

only the tax portion in this column.

Unit or Lot Number - Enter the specific unit, cooperative apartment

Special Instructions for Taxpayers with Existing

or lot number for each of the units, cooperative apartments or parcels

Installment Payment Plans –

transferred.

If the tax is currently being paid

in installments for any unit(s), cooperative apartment(s) or parcel(s),

Transferee - Enter the name(s) of each of the unit, cooperative

put an ‘‘X’’ in the Amount of Tax Paid column for that unit(s),

apartment or lot purchasers.

cooperative apartment(s) or parcel(s). Attach a schedule to Form

Individual Apportionment - Enter the number of shares, number of

DTF-1004 indicating each unit, cooperative apartment or lot number,

units, percentage of common elements, square footage, parcels or

the installment number, the amount of tax required to be paid, and the

acreage allocated to the individual unit(s), cooperative apartment(s) or

amount of each installment payment and the date(s) the installment

lot(s) transferred after March 28, 1983, but before June 15, 1996.

payment(s) was made.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1