Form Rct-127 A - Public Utility Realty Tax Report Form - Pa Department Of Revenue Page 2

ADVERTISEMENT

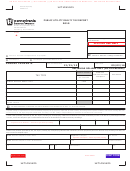

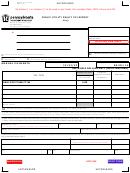

R C T- 1 2 7 A

SCHEDULE 1 (PART 1)

Page 2

2006 COUNTY SUMMARIES

1 2 7 1 0 0 6 2 0 1 0

PURTA UTILITY REALTY TAX REPORT

UTILITY NAME

ACCOUNT ID

COLUMN 1

COLUMN 5

COLUMN 2

COLUMN 3

COLUMN 4

PURTA – REAL ESTATE COUNTY

EQUALIZED TAXABLE VALUE

APPEALED ASSESSMENTS

COMMON LEVEL RATIO

C O U N T Y

COUNTY

S TATE TAXABLE VA L U E

ASSESSED VALUE

(CLR) FACTOR*

COLUMN 1 X COLUMN 2

STIPULATED

C O D E

NAME

COLUMN 3 + COLUMN 4

DO NOT INCLUDE PENDING

(EFFECTIVE 7-1-06)

(ALSO COMPLETE

MARKET VALUE

APPEAL PARCEL VALUES

SCHEDULE 2)

0 1

A D A M S

3 . 9 8

0 2

A L L E G H E N Y

1 . 1 0

0 3

A R M S T R O N G

2 . 7 0

0 4

B E AV E R

3 . 3 1

0 5

B E D F O R D

5 . 4 7

0 6

B E R K S

1 . 3 3

0 7

B L A I R

1 2 . 2 0

0 8

B R A D F O R D

2 . 6 3

0 9

B U C K S

1 0 . 1 0

1 0

B U T L E R

1 0 . 2 0

11

C A M B R I A

3 . 6 0

1 2

C A M E R O N

3 . 0 8

1 3

C A R B O N

2 . 7 4

1 4

C E N T R E

3 . 2 4

1 5

C H E S T E R

1 . 8 2

1 6

C L A R I O N

5 . 3 8

1 7

C L E A R F I E L D

5 . 4 7

1 8

C L I N TO N

4 . 2 4

1 9

C O L U M B I A

3 . 4 7

2 0

C R AW F O R D

3 . 0 2

2 1

C U M B E R L A N D

1 . 1 4

2 2

D A U P H I N

1 . 3 3

2 3

D E L AW A R E

1 . 5 5

2 4

E L K

2 . 1 8

2 5

E R I E

1 . 1 8

2 6

FAY E T T E

1 . 1 4

2 7

F O R E S T

4 . 8 3

2 8

F R A N K L I N

9 . 3 5

2 9

F U LTO N

2 . 6 1

3 0

G R E E N E

1 . 2 1

3 1

H U N T I N G D O N

7 . 4 6

3 2

I N D I A N A

4 . 3 5

3 3

J E F F E R S O N

1 . 8 5

3 4

J U N I ATA

6 . 2 1

0 1 - 3 4

S U B TO TA L

*The real estate valuation factors are based on sales

data complied by the PA State Tax Equalization Board.

These factors are the mathematical reciprocals of the

actual common level ratios.

1 2 7 1 0 0 6 2 0 1 0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10