Form Pv84 - Nonprofit Organization Extension Payment

ADVERTISEMENT

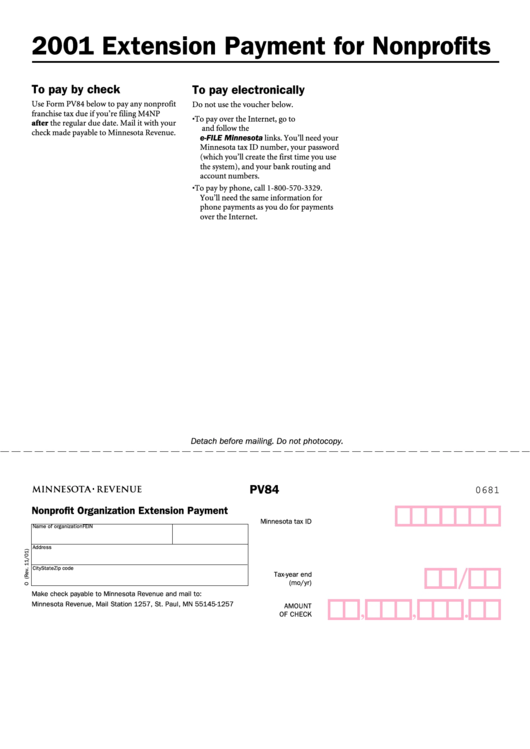

2001 Extension Payment for Nonprofits

To pay by check

To pay electronically

Use Form PV84 below to pay any nonprofit

Do not use the voucher below.

franchise tax due if you’re filing M4NP

• To pay over the Internet, go to

after the regular due date. Mail it with your

and follow the

check made payable to Minnesota Revenue.

e-FILE Minnesota links. You’ll need your

Minnesota tax ID number, your password

(which you’ll create the first time you use

the system), and your bank routing and

account numbers.

• To pay by phone, call 1-800-570-3329.

You’ll need the same information for

phone payments as you do for payments

over the Internet.

Detach before mailing. Do not photocopy.

PV84

0681

Nonprofit Organization Extension Payment

Minnesota tax ID

Name of organization

FEIN

Address

City

State

Zip code

Tax-year end

(mo/yr)

Make check payable to Minnesota Revenue and mail to:

Minnesota Revenue, Mail Station 1257, St. Paul, MN 55145-1257

AMOUNT

.

,

,

OF CHECK

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1