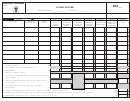

Schedule F Individual - Other Income - 2007 Page 3

ADVERTISEMENT

Schedule F Individual - Page 3

Rev. 11.07

Taxpayer's name

Social Security Number

Part VI

Miscellaneous Income

Column A

Column B

Column C

Column D

Income from Major League

Judicial or

Income from

Employer Identification

Baseball teams and the U.S.

Account Number

Miscellaneous

Payer's name

Extrajudicial

Prizes and Contests

Income

National Basketball Association

Number

Indemnification

00

00

00

00

(17)

00

00

00

00

(18)

00

00

00

00

(19)

00

(20)

00

00

(21)

00

(23)

(22)

1.

Total ..............................................................................................................................................................

00

Tax on income from Major League Baseball teams and the U.S. National Basketball Association (20% of line 1D. Transfer to Part 4, line 25 of the return) .....................................................................

2.

(24)

Total miscellaneous income (Add total of Columns A, B and C. Transfer to Part 2, line 2H of the return) ...........................................................................................................................................

3.

(25)

00

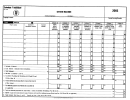

Distributions from Individual Retirement Accounts and Educational Contribution Accounts

Taxable Amount

Part VII

Column A

Column B

Column C

Column D

Column E

IRA or Educational

Account

Payer's name

Employer

Fill in if

IRA Distributions to

IRA or Educational

Contribution Account

Identification

you

Number

Government Pensioners

Total Distribution

Contribution Accounts

Basis

Distribution of Income from

Prepaid

Number

(excluding contributions)

Distributions

Sources Within P.R.

00

00

00

00

00

(26)

00

00

00

00

00

(27)

00

00

00

00

00

(28)

00

00

00

00

00

(29)

00

00

00

00

00

(30)

00

00

00

00

00

(31)

00

00

00

00

00

(32)

(33)

(34)

(35)

1.

Total ...............................................................................................................................................

00

2.

Tax on IRA or Educational Contribution Accounts distributions of income from sources within P.R. (17% of line 1D. Enter in Part 4, line 21 of the return) ........................................................

(36)

00

3.

Tax on IRA distributions to Government pensioners (10% of line 1E. Enter in Part 4, line 22 of the return) .................................................................................................................................

(37)

4.

Option to pay taxes from distributions of income from sources within P.R. and from distributions to Government pensioners as ordinary income (Enter total of Columns D and/or E,

00

only if you elected to include such distributions as ordinary income) ...........................................................................................................................................................................................

(38)

00

5.

Total distributions from Individual Retirement Accounts and Educational Contribution Accounts (Add total of Column C and line 4. Transfer to Part 2, line 2 I of the return) ................................

(39)

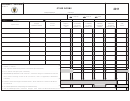

Part VIII

Distributions from Deferred Compensation Plans (Non Qualified)

(A)

Fill in if you

Distribution

(B)

(C)

Description

Total Distribution

Prepaid

Date

Basis

Taxable Amount

1. Taxable as ordinary income (Transfer to Part VI, Column A of this Schedule) ............................................

00

00

00

(40)

(41)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3