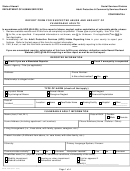

Form 14242 - Report Suspected Abusive Tax Promotions Or Preparers Form Page 2

ADVERTISEMENT

10. How is the promoter involved in the promotion (Describe promoters involvement)

11. Who is the target group of the promotion (Describe industry or type of taxpayer, i.e. nurse, policeman, home business, etc.)

12. a. Are you aware of any similar promotions in your area

Yes

No

b. If YES, describe the other promotions and any similarities they have to this promotion

13. Is the promotion still being advertised

Yes

No

14. Describe the tax benefits of the promotion (Provide any information used to explain the tax benefits of the promotion)

15. Describe the geographic scope of the promotion. For example, is it restricted to a small area, nationwide, or worldwide

16. Do you know of any tax preparers completing returns for investors or promoters based upon this promotion

Yes

No

If YES, provide the following information (if available) (If more than one preparer is involved, provide information on all preparers)

Name of preparer(s)

Mailing address of preparer(s)

Telephone number of preparer(s)

Social Security Number (SSN) of preparer(s)

17. Did you have any private/personal conversations with the promoter/accountant/return preparer/associate

Yes

No

If YES, provide the following information (if available)

With whom did you have a conversation

What did they say during the conversation

Where did this conversation take place

When did this conversation take place (mm/dd/yyyy)

When this conversation took place, if anyone else was present, list their names

18. a What is your current relationship with the promoter(s)

b. Did you have personal/telephone contact with any of the promoters

Yes

No

19. Do you know any individuals/businesses that have purchased or used the promotion

Yes

No

If YES, provide their names

14242

Department of the Treasury - Internal Revenue Service

Form

(Rev. 2-2013) Catalog Number 57652G

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3