Computation Of Wages Earned In Hudson Schedule

ADVERTISEMENT

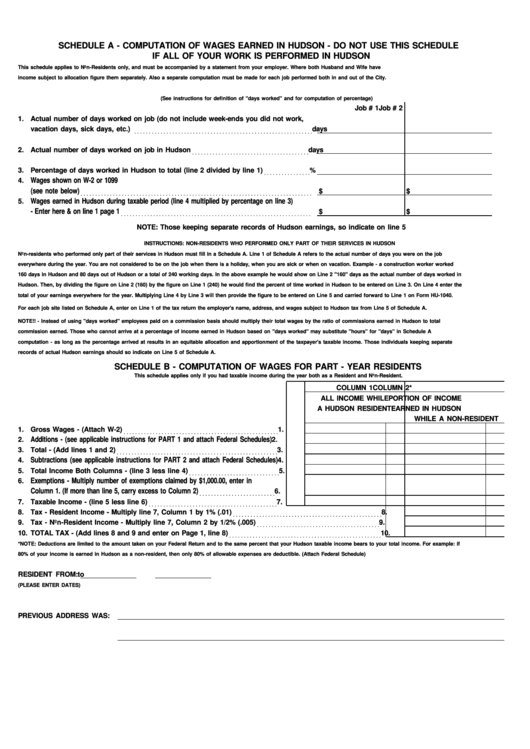

SCHEDULE A - COMPUTATION OF WAGES EARNED IN HUDSON - DO NOT USE THIS SCHEDULE

IF ALL OF YOUR WORK IS PERFORMED IN HUDSON

This schedule applies to Non-Residents only, and must be accompanied by a statement from your employer. Where both Husband and Wife have

income subject to allocation figure them separately. Also a separate computation must be made for each job performed both in and out of the City.

(See instructions for definition of "days worked" and for computation of percentage)

Job # 1

Job # 2

1. Actual number of days worked on job (do not include week-ends you did not work,

vacation days, sick days, etc.)

days

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Actual number of days worked on job in Hudson

days

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Percentage of days worked in Hudson to total (line 2 divided by line 1)

%

. . . . . . . . . . . . . . . .

Wages shown on W-2 or 1099

4.

(see note below)

$

$

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Wages earned in Hudson during taxable period (line 4 multiplied by percentage on line 3)

5.

- Enter here & on line 1 page 1

$

$

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTE: Those keeping separate records of Hudson earnings, so indicate on line 5

INSTRUCTIONS: NON-RESIDENTS WHO PERFORMED ONLY PART OF THEIR SERVICES IN HUDSON

Non-residents who performed only part of their services in Hudson must fill in a Schedule A. Line 1 of Schedule A refers to the actual number of days you were on the job

everywhere during the year. You are not considered to be on the job when there is a holiday, when you are sick or when on vacation. Example - a construction worker worked

160 days in Hudson and 80 days out of Hudson or a total of 240 working days. In the above example he would show on Line 2 "160" days as the actual number of days worked in

Hudson. Then, by dividing the figure on Line 2 (160) by the figure on Line 1 (240) he would find the percent of time worked in Hudson to be entered on Line 3. On Line 4 enter the

total of your earnings everywhere for the year. Multiplying Line 4 by Line 3 will then provide the figure to be entered on Line 5 and carried forward to Line 1 on Form HU-1040.

For each job site listed on Schedule A, enter on Line 1 of the tax return the employer's name, address, and wages subject to Hudson tax from Line 5 of Schedule A.

NOTE!! - Instead of using "days worked" employees paid on a commission basis should multiply their total wages by the ratio of commissions earned in Hudson to total

commission earned. Those who cannot arrive at a percentage of income earned in Hudson based on "days worked" may substitute "hours" for "days" in Schedule A

computation - as long as the percentage arrived at results in an equitable allocation and apportionment of the taxpayer's taxable income. Those individuals keeping separate

records of actual Hudson earnings should so indicate on Line 5 of Schedule A.

SCHEDULE B - COMPUTATION OF WAGES FOR PART - YEAR RESIDENTS

This schedule applies only if you had taxable income during the year both as a Resident and Non-Resident.

COLUMN 1

COLUMN 2*

ALL INCOME WHILE

PORTION OF INCOME

A HUDSON RESIDENT

EARNED IN HUDSON

WHILE A NON-RESIDENT

1. Gross Wages - (Attach W-2)

1.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Additions - (see applicable instructions for PART 1 and attach Federal Schedules)

2.

2.

3. Total - (Add lines 1 and 2)

3.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Subtractions (see applicable instructions for PART 2 and attach Federal Schedules)

4.

4.

5. Total Income Both Columns - (line 3 less line 4)

5.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Exemptions - Multiply number of exemptions claimed by $1,000.00, enter in

6.

Column 1. (If more than line 5, carry excess to Column 2)

6.

. . . . . . . . . . . . . . . . . . . . . . . . . .

7. Taxable Income - (line 5 less line 6)

7.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Tax - Resident Income - Multiply line 7, Column 1 by 1% (.01)

8.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Tax - Non-Resident Income - Multiply line 7, Column 2 by 1/2% (.005)

9.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. TOTAL TAX - (Add lines 8 and 9 and enter on Page 1, line 8)

10.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

*NOTE: Deductions are limited to the amount taken on your Federal Return and to the same percent that your Hudson taxable income bears to your total income. For example: if

80% of your income is earned in Hudson as a non-resident, then only 80% of allowable expenses are deductible. (Attach Federal Schedule)

RESIDENT FROM:

to

(PLEASE ENTER DATES)

PREVIOUS ADDRESS WAS:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2