Form Ct-990t Esa - Estimated Unrelated Business Income Tax - Department Of Revenue Services - 2017

ADVERTISEMENT

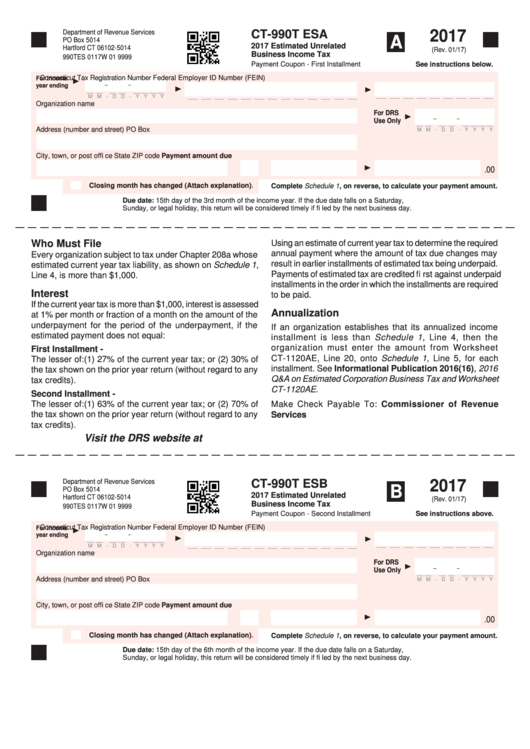

Department of Revenue Services

CT-990T ESA

2017

A

PO Box 5014

2017 Estimated Unrelated

Hartford CT 06102-5014

(Rev. 01/17)

Business Income Tax

990TES 0117W 01 9999

Payment Coupon - First Installment

See instructions below.

Connecticut Tax Registration Number

Federal Employer ID Number (FEIN)

For income

year ending

M M - D D - Y Y Y Y

Organization name

For DRS

Use Only

Address (number and street)

PO Box

M M - D D - Y Y Y Y

City, town, or post offi ce

State

ZIP code

Payment amount due

.00

Closing month has changed (Attach

explanation).

Complete Schedule 1, on reverse, to calculate your payment amount.

Due date: 15th day of the 3rd month of the income year. If the due date falls on a Saturday,

Sunday, or legal holiday, this return will be considered timely if fi led by the next business day.

Who Must File

Using an estimate of current year tax to determine the required

annual payment where the amount of tax due changes may

Every organization subject to tax under Chapter 208a whose

result in earlier installments of estimated tax being underpaid.

estimated current year tax liability, as shown on Schedule 1,

Payments of estimated tax are credited fi rst against underpaid

Line 4, is more than $1,000.

installments in the order in which the installments are required

Interest

to be paid.

If the current year tax is more than $1,000, interest is assessed

Annualization

at 1% per month or fraction of a month on the amount of the

underpayment for the period of the underpayment, if the

If an organization establishes that its annualized income

estimated payment does not equal:

installment is less than Schedule 1, Line 4, then the

organization must enter the amount from Worksheet

First Installment -

CT-1120AE, Line 20, onto Schedule 1, Line 5, for each

The lesser of:(1) 27% of the current year tax; or (2) 30% of

installment. See Informational Publication 2016(16), 2016

the tax shown on the prior year return (without regard to any

Q&A on Estimated Corporation Business Tax and Worksheet

tax credits).

CT-1120AE.

Second Installment -

The lesser of:(1) 63% of the current year tax; or (2) 70% of

Make Check Payable To: Commissioner of Revenue

the tax shown on the prior year return (without regard to any

Services

tax credits).

Visit the DRS website at to pay this return electronically.

Department of Revenue Services

CT-990T ESB

2017

B

PO Box 5014

2017 Estimated Unrelated

Hartford CT 06102-5014

(Rev. 01/17)

Business Income Tax

990TES 0117W 01 9999

Payment Coupon - Second Installment

See instructions above.

Connecticut Tax Registration Number

Federal Employer ID Number (FEIN)

For income

year ending

M M - D D - Y Y Y Y

Organization name

For DRS

Use Only

Address (number and street)

PO Box

M M - D D - Y Y Y Y

City, town, or post offi ce

State

ZIP code

Payment amount due

.00

Closing month has changed (Attach

explanation).

Complete Schedule 1, on reverse, to calculate your payment amount.

Due date: 15th day of the 6th month of the income year. If the due date falls on a Saturday,

Sunday, or legal holiday, this return will be considered timely if fi led by the next business day.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4