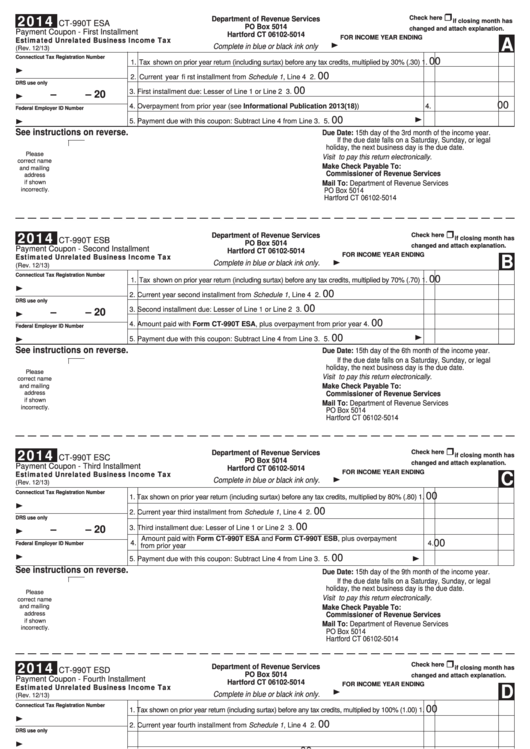

2014

Department of Revenue Services

Check here

if closing month has

CT-990T ESA

PO Box 5014

changed and attach explanation.

Payment Coupon - First Installment

Hartford CT 06102-5014

Estimated Unrelated Business Income Tax

FOR INCOME YEAR ENDING

A

Complete in blue or black ink only

(Rev. 12/13)

Connecticut Tax Registration Number

00

1. Tax shown on prior year return (including surtax) before any tax credits, multiplied by 30% (.30)

1.

00

2. Current year fi rst installment from Schedule 1, Line 4

2.

DRS use only

00

3. First installment due: Lesser of Line 1 or Line 2

3.

–

– 20

00

4. Overpayment from prior year (see Informational Publication 2013(18))

4.

Federal Employer ID Number

00

5. Payment due with this coupon: Subtract Line 4 from Line 3.

5.

See instructions on reverse.

Due Date: 15th day of the 3rd month of the income year.

If the due date falls on a Saturday, Sunday, or legal

holiday, the next business day is the due date.

Please

Visit to pay this return electronically.

correct name

Make Check Payable To:

and mailing

Commissioner of Revenue Services

address

if shown

Mail To:

Department of Revenue Services

incorrectly.

PO Box 5014

Hartford CT 06102-5014

2014

Department of Revenue Services

Check here

if closing month has

CT-990T ESB

PO Box 5014

changed and attach explanation.

Payment Coupon - Second Installment

Hartford CT 06102-5014

Estimated Unrelated Business Income Tax

FOR INCOME YEAR ENDING

B

Complete in blue or black ink only.

(Rev. 12/13)

Connecticut Tax Registration Number

00

1. Tax shown on prior year return (including surtax) before any tax credits, multiplied by 70% (.70)

1.

00

2. Current year second installment from Schedule 1, Line 4

2.

DRS use only

00

3. Second installment due: Lesser of Line 1 or Line 2

3.

–

– 20

00

4. Amount paid with Form CT-990T ESA, plus overpayment from prior year

4.

Federal Employer ID Number

00

5. Payment due with this coupon: Subtract Line 4 from Line 3.

5.

See instructions on reverse.

Due Date: 15th day of the 6th month of the income year.

If the due date falls on a Saturday, Sunday, or legal

holiday, the next business day is the due date.

Please

Visit to pay this return electronically.

correct name

and mailing

Make Check Payable To:

Commissioner of Revenue Services

address

if shown

Mail To:

Department of Revenue Services

incorrectly.

PO Box 5014

Hartford CT 06102-5014

2014

Department of Revenue Services

Check here

if closing month has

CT-990T ESC

PO Box 5014

changed and attach explanation.

Payment Coupon - Third Installment

Hartford CT 06102-5014

Estimated Unrelated Business Income Tax

FOR INCOME YEAR ENDING

C

Complete in blue or black ink only.

(Rev. 12/13)

Connecticut Tax Registration Number

00

1. Tax shown on prior year return (including surtax) before any tax credits, multiplied by 80% (.80)

1.

00

2. Current year third installment from Schedule 1, Line 4

2.

DRS use only

00

–

– 20

3. Third installment due: Lesser of Line 1 or Line 2

3.

Amount paid with Form CT-990T ESA and Form CT-990T ESB, plus overpayment

00

4.

4.

Federal Employer ID Number

from prior year

00

5. Payment due with this coupon: Subtract Line 4 from Line 3.

5.

See instructions on reverse.

Due Date: 15th day of the 9th month of the income year.

If the due date falls on a Saturday, Sunday, or legal

holiday, the next business day is the due date.

Please

Visit to pay this return electronically.

correct name

and mailing

Make Check Payable To:

address

Commissioner of Revenue Services

if shown

Mail To:

Department of Revenue Services

incorrectly.

PO Box 5014

Hartford CT 06102-5014

2014

Department of Revenue Services

Check here

if closing month has

CT-990T ESD

PO Box 5014

changed and attach explanation.

Payment Coupon - Fourth Installment

Hartford CT 06102-5014

Estimated Unrelated Business Income Tax

FOR INCOME YEAR ENDING

D

Complete in blue or black ink only.

(Rev. 12/13)

Connecticut Tax Registration Number

00

1. Tax shown on prior year return (including surtax) before any tax credits, multiplied by 100% (1.00)

1.

00

2. Current year fourth installment from Schedule 1, Line 4

2.

DRS use only

00

3. Fourth installment due: Lesser of Line 1 or Line 2

3.

–

– 20

Amount paid with Form CT-990T ESA, Form CT-990T ESB, and Form CT-990T ESC,

00

4.

4.

Federal Employer ID Number

plus overpayment from prior year

00

5. Payment due with this coupon: Subtract Line 4 from Line 3.

5.

See instructions on reverse.

Due Date: 15th day of the 12th month of the income year.

If the due date falls on a Saturday, Sunday, or legal

holiday, the next business day is the due date.

Please

Visit to pay this return electronically.

correct name

Make Check Payable To:

and mailing

address

Commissioner of Revenue Services

if shown

Mail To:

Department of Revenue Services

incorrectly.

PO Box 5014

Hartford CT 06102-5014

1

1 2

2