Form Pt-11 Instructions Sheet

ADVERTISEMENT

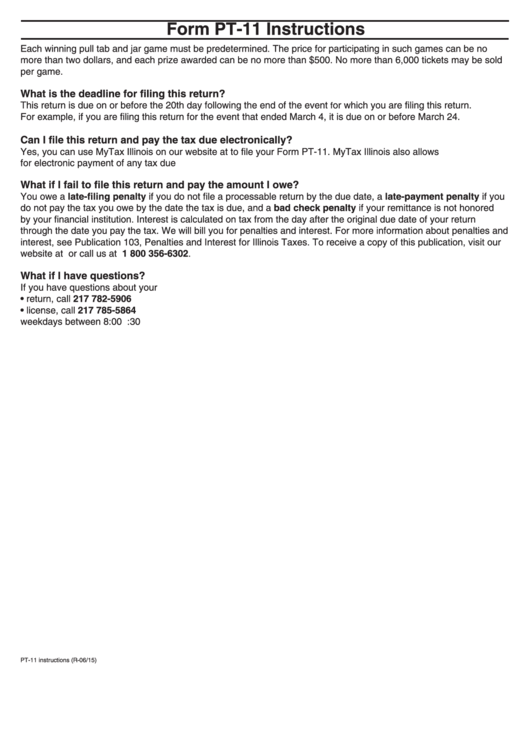

Form PT-11 Instructions

Each winning pull tab and jar game must be predetermined. The price for participating in such games can be no

more than two dollars, and each prize awarded can be no more than $500. No more than 6,000 tickets may be sold

per game.

What is the deadline for filing this return?

This return is due on or before the 20th day following the end of the event

or which you are filing this return.

f

For example, if you are filing this return for the event that ended March 4, it is due on or before March 24.

Can I file this return and pay the tax due electronically?

Yes, you can use MyTax Illinois on our website at tax.illinois.gov to file your Form PT-11. MyTax Illinois also allows

for electronic payment of any tax due

What if I fail to file this return and pay the amount I owe?

You owe a late-filing penalty if you do not file a processable return by the due date, a late-payment penalty if you

do not pay the tax you owe by the date the tax is due, and a bad check penalty if your remittance is not honored

by your financial institution. Interest is calculated on tax from the day after the original due date of your return

through the date you pay the tax. We will bill you for penalties and interest. For more information about penalties and

interest, see Publication 103, Penalties and Interest for Illinois Taxes. To receive a copy of this publication, visit our

website at tax.illinois.gov or call us at 1 800 356-6302.

What if I have questions?

If you have questions about your

• return, call 217 782-5906

• license, call 217 785-5864

weekdays between 8:00 a.m. and 4:30 p.m.

PT-11 instructions (R-06/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1