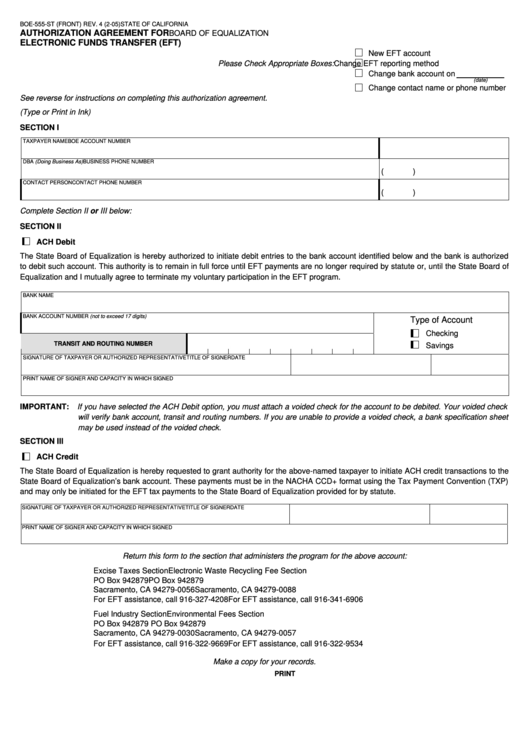

BOE-555-ST (FRONT) REV. 4 (2-05)

STATE OF CALIFORNIA

AUTHORIZATION AGREEMENT FOR

BOARD OF EQUALIZATION

ELECTRONIC FUNDS TRANSFER (EFT)

New EFT account

Please Check Appropriate Boxes:

Change EFT reporting method

Change bank account on

(date)

Change contact name or phone number

See reverse for instructions on completing this authorization agreement.

(Type or Print in Ink)

SECTION I

TAXPAYER NAME

BOE ACCOUNT NUMBER

DBA (Doing Business As)

BUSINESS PHONE NUMBER

(

)

CONTACT PERSON

CONTACT PHONE NUMBER

(

)

Complete Section II or III below:

SECTION II

ACH Debit

The State Board of Equalization is hereby authorized to initiate debit entries to the bank account identified below and the bank is authorized

to debit such account. This authority is to remain in full force until EFT payments are no longer required by statute or, until the State Board of

Equalization and I mutually agree to terminate my voluntary participation in the EFT program.

BANK NAME

BANK ACCOUNT NUMBER (not to exceed 17 digits)

Type of Account

Checking

TRANSIT AND ROUTING NUMBER

Savings

SIGNATURE OF TAXPAYER OR AUTHORIZED REPRESENTATIVE

TITLE OF SIGNER

DATE

PRINT NAME OF SIGNER AND CAPACITY IN WHICH SIGNED

IMPORTANT:

If you have selected the ACH Debit option, you must attach a voided check for the account to be debited. Your voided check

will verify bank account, transit and routing numbers. If you are unable to provide a voided check, a bank specification sheet

may be used instead of the voided check.

SECTION III

ACH Credit

The State Board of Equalization is hereby requested to grant authority for the above-named taxpayer to initiate ACH credit transactions to the

State Board of Equalization’s bank account. These payments must be in the NACHA CCD+ format using the Tax Payment Convention (TXP)

and may only be initiated for the EFT tax payments to the State Board of Equalization provided for by statute.

SIGNATURE OF TAXPAYER OR AUTHORIZED REPRESENTATIVE

TITLE OF SIGNER

DATE

PRINT NAME OF SIGNER AND CAPACITY IN WHICH SIGNED

Return this form to the section that administers the program for the above account:

Excise Taxes Section

Electronic Waste Recycling Fee Section

PO Box 942879

PO Box 942879

Sacramento, CA 94279-0056

Sacramento, CA 94279-0088

For EFT assistance, call 916-327-4208

For EFT assistance, call 916-341-6906

Fuel Industry Section

Environmental Fees Section

PO Box 942879

PO Box 942879

Sacramento, CA 94279-0030

Sacramento, CA 94279-0057

For EFT assistance, call 916-322-9669

For EFT assistance, call 916-322-9534

Make a copy for your records.

CLEAR

PRINT

1

1 2

2