Instructions For Filing Form I-290x

ADVERTISEMENT

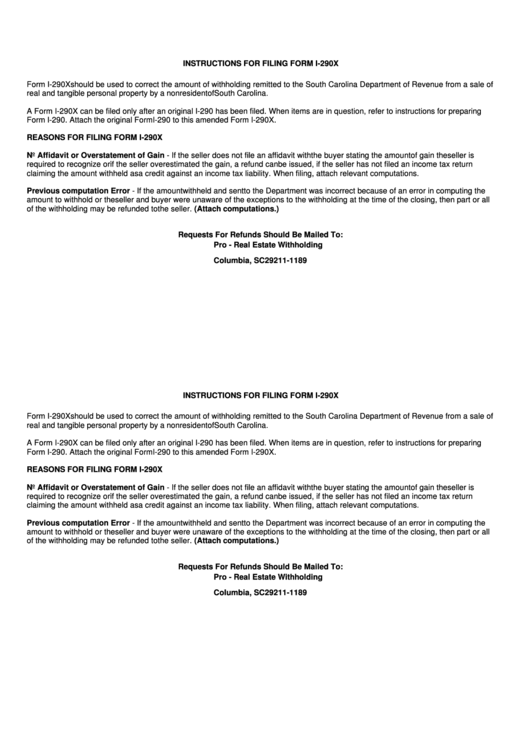

INSTRUCTIONS FOR FILING FORM I-290X

Form I-290X should be used to correct the amount of withholding remitted to the South Carolina Department of Revenue from a sale of

real and tangible personal property by a nonresident of South Carolina.

A Form I-290X can be filed only after an original I-290 has been filed. When items are in question, refer to instructions for preparing

Form I-290. Attach the original Form I-290 to this amended Form I-290X.

REASONS FOR FILING FORM I-290X

No Affidavit or Overstatement of Gain - If the seller does not file an affidavit with the buyer stating the amount of gain the seller is

required to recognize or if the seller overestimated the gain, a refund can be issued, if the seller has not filed an income tax return

claiming the amount withheld as a credit against an income tax liability. When filing, attach relevant computations.

Previous computation Error - If the amount withheld and sent to the Department was incorrect because of an error in computing the

amount to withhold or the seller and buyer were unaware of the exceptions to the withholding at the time of the closing, then part or all

of the withholding may be refunded to the seller. (Attach computations.)

Requests For Refunds Should Be Mailed To:

Pro - Real Estate Withholding

P.O. Box 11189

Columbia, SC 29211-1189

INSTRUCTIONS FOR FILING FORM I-290X

Form I-290X should be used to correct the amount of withholding remitted to the South Carolina Department of Revenue from a sale of

real and tangible personal property by a nonresident of South Carolina.

A Form I-290X can be filed only after an original I-290 has been filed. When items are in question, refer to instructions for preparing

Form I-290. Attach the original Form I-290 to this amended Form I-290X.

REASONS FOR FILING FORM I-290X

No Affidavit or Overstatement of Gain - If the seller does not file an affidavit with the buyer stating the amount of gain the seller is

required to recognize or if the seller overestimated the gain, a refund can be issued, if the seller has not filed an income tax return

claiming the amount withheld as a credit against an income tax liability. When filing, attach relevant computations.

Previous computation Error - If the amount withheld and sent to the Department was incorrect because of an error in computing the

amount to withhold or the seller and buyer were unaware of the exceptions to the withholding at the time of the closing, then part or all

of the withholding may be refunded to the seller. (Attach computations.)

Requests For Refunds Should Be Mailed To:

Pro - Real Estate Withholding

P.O. Box 11189

Columbia, SC 29211-1189

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1