AZ FORM 819NR

Instructions

of such cigarettes does not market or advertise such

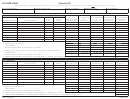

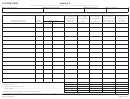

Specifi c Instructions for Schedule B-1

Reservations That Have Not Enacted Their Own Tax.

cigarettes in the United States);

2) Is the fi rst purchaser anywhere for resale in the United States

Retailers whose registration numbers end in “-1” are either owned

of cigarettes manufactured anywhere that the manufacturer

by an Indian tribe, a tribal enterprise, or an enrolled member of the

does not intend to be sold in the United States; or

tribe. These retailers should collect both the §42-3251 and the

§42-3251.01 tax rates when selling to a non-enrolled member of

3) Becomes a successor of an entity described in paragraph 1

the tribe.

or 2.

Retailers whose registration numbers end in “-2” are licensed

The term “tobacco product manufacturer” does not include an

Indian traders. These retailers should collect the §42-3052, the

affi liate of a tobacco product manufacturer unless such affi liate

§42-3251, and the §42-3251.01 tax rates when selling to a non-

itself falls within any of paragraphs 1 through 3 above.

enrolled member of the tribe.

“Participating manufacturer” has the same meaning prescribed

For “-1” retailers, enter the registration number, name, invoice

in Section II(jj) of the Master Settlement Agreement and all

date and number, and the total number of items or total number of

amendments thereto. A list of participating manufacturers and

ounces sold, whichever is applicable. Do not round ounces of

their brands is maintained and updated at the web site of the

individual packages.

National Association of Attorneys General,

Line 1: Sum the total number of items sold and the total number of

“Nonparticipating manufacturer” (NPM) means any tobacco

ounces sold from all invoices. If necessary, round the total number

product manufacturer that is not a Participating Manufacturer.

of ounces sold from all invoices to the whole ounce. Round partial

“State excise taxes” means taxes imposed on tobacco products

ounces of cavendish, plug, or twist up to the next highest ounce

under A.R.S. Title 42, Chapter 3.

(i.e., round .1 oz. - .9 oz. up to 1 oz.). Round partial ounces of

smoking tobacco, snuff, fi ne cut chewing, etc. to the nearest ounce

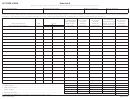

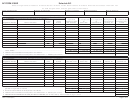

Special Instructions for Schedule A-3

(i.e., round .1 oz. - .4 oz. down to 0 oz., round .5 oz. - .9 oz. up to

Participating Manufacturer’s Roll-Your-Own Tobacco

1 oz.). Enter totals here.

Sold in Arizona

Line 2: Calculate the number of items and number of ounces from

This report must be completed for every roll-your-own tobacco

line 1 that were sold tax free. Enter totals here.

brand family manufactured by a participating manufacturer for

Line 3: Multiply the totals on line 2 by the total tax rates. Enter

which the distributor paid state excise taxes.

amounts here.

Column (a): Enter the name of the participating manufacturer

Line 4: Calculate the number of items and number of ounces from

of the brand family of participating manufacturer roll-your-own

line 1 that were sold for which the §42-3251 and the §42-3251.01

tobacco reported in Column (c).

tax rates were collected. Enter totals here.

Column (b): Enter the name and address of who the brand family

Line 5: Multiply the totals on line 4 by the §42-3052 tax rates.

of roll-your-own tobacco, reported in column (c), was sold to.

Enter amounts here.

Column (c):

Enter the complete brand family name of the

Line 6: Add amounts from lines 3 and 5. Enter total here.

participating manufacturer roll-your-own tobacco.

Do not

abbreviate.

For “-2” retailers, enter the registration number, name, invoice

Column (d):

Enter the number of ounces of participating

date and number, and the total number of items or total number of

ounces sold, whichever is applicable. Do not round ounces of

manufacturer roll-your-own tobacco for which the distributor paid

individual packages.

state excise taxes.

Line 7: Sum the total number of items sold and the total number of

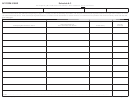

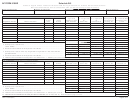

Special Instructions for Schedule A-4

ounces sold from all invoices. If necessary, round the total number

Nonparticipating Manufacturer’s (NPM) Roll-Your-Own

of ounces sold from all invoices to the whole ounce. Round partial

Tobacco Sold in Arizona

ounces of cavendish, plug, or twist up to the next highest ounce

This report must be completed for every roll-your-own tobacco

(i.e., round .1 oz. - .9 oz. up to 1 oz.). Round partial ounces of

brand family manufactured by a NPM for which the distributor paid

smoking tobacco, snuff, fi ne cut chewing, etc. to the nearest ounce

state excise taxes.

(i.e., round .1 oz. - .4 oz. down to 0 oz., round .5 oz. - .9 oz. up to

1 oz.). Enter totals here.

Attach copies of invoices to Schedule A-4 for nonparticipating

Line 8: Calculate the number of items and number of ounces from

manufacturers roll-your-own tobacco products shipped into

Arizona.

line 7 that were sold tax free. Enter totals here.

Column (a): Enter the name and address of the nonparticipating

Line 9: Multiply the totals on line 8 by the total tax rate. Enter

manufacturer of the brand family of NPM roll-your-own tobacco

amounts here.

reported in Column (c).

Line 10: Add amounts from line 9. Enter total here.

Column (b): Enter the name and address of who the NPM roll-

Line 11: Add lines 6 and 10. Enter total here, and on page 1,

your-own tobacco, reported in column (c) was sold to.

line 2.

Column (c): Enter the date and invoice number of the invoice

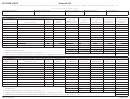

Specifi c Instructions for Schedule B-2

pursuant to which you sold the roll-your-own tobacco identifi ed in

Reservations That Have Enacted And Collect Their Own Tax

Column (d).

for Only the §42-3251 Tax Rate

Column (d): Enter the complete brand family of the NPM roll-

Retailers whose registration numbers end in “-1” are either owned

your-own tobacco. Do not abbreviate.

by an Indian tribe, a tribal enterprise, or an enrolled member of

Column (e): Enter the number of ounces of NPM roll-your-own

the tribe.

tobacco for which the distributor paid state excise taxes.

Page 15 of 17

ADOR 14-5322 (8/05)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17