AZ FORM 819NR

Instructions

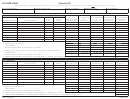

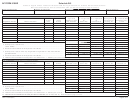

Line 9: Multiply the totals on line 8 by the total tax rate. Enter

(i.e., round .1 oz. - .9 oz. up to 1 oz.). Round partial ounces of

smoking tobacco, snuff, fi ne cut chewing, etc. to the nearest ounce

amounts here.

(i.e., round .1 oz. - .4 oz. down to 0 oz., round .5 oz. - .9 oz. up to

Line 10: Add amounts from line 9. Enter total here.

1 oz.). Enter totals here.

Line 11: Add lines 6 and 10. Enter total here and on page 1,

Line 7: Multiply the totals from line 6 by the total tax rates. Enter

line 4b.

amounts here.

Line 8: Add amounts from line 7. Enter total here.

NOTE: Form 819NR does not contain

Line 9: Add lines 5 and 8. Enter total here. Do not include total

Schedule C-1 or Schedule C-2.

on page 1, line 4a.

Special Instructions for Schedule C-3

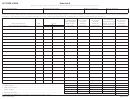

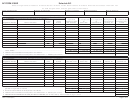

Specifi c Instructions for Schedule B-5

List each invoice on a separate line with the name of the taxpaying

Reservations That Have Enacted Their Own Tax That

distributor, the date and number of the invoice, and the number of

Exempts Tribal Members And Is Collected By The Arizona

items or total number of ounces shipped, whichever is applicable.

Department of Revenue

These sales should also be listed on Schedule A.

Retailers whose registration numbers end in “-1” are either

Sum the total number of items shipped and the total number of

owned by an Indian tribe, a tribal enterprise, or an enrolled

ounces shipped from all invoices. If necessary, round the total

member of the tribe. These retailers should collect the §42-3251

number of ounces shipped from all invoices to the whole ounce.

and §42-3251.01 tax rates when selling to a non-enrolled

Round partial ounces of cavendish, plug, or twist up to the next

member of the tribe.

highest ounce (i.e., round .1 oz. - .9 oz. up to 1 oz.). Round partial

ounces of smoking tobacco, snuff, fi ne cut chewing, etc. to the

Retailers whose registration numbers end in “-2” are licensed

nearest ounce (i.e., round .1 oz. - .4 oz. down to 0 oz., round .5 oz.

Indian traders. These retailers should collect the §42-3052, the

- .9 oz. up to 1 oz.).

§42-3251, and the §42-3251.01 tax rates when selling to a non-

enrolled member of the tribe.

Multiply the total number of items and the total number of ounces

shipped during the month by the appropriate tax rates to calculate

For “-1” retailers, enter the registration number, name, invoice

“Net Non-Taxable Sales This Month.”

date and number, and the total number of items or total number of

ounces sold, whichever is applicable. Do not round ounces of

Sum the “Net Non-Taxable Sales This Month” to calculate the

individual packages.

“Total Non-Taxable Sales This Month” amount. Enter this amount

on page 1, line 5.

Line 1: Sum the total number of items sold and the total number of

ounces sold from all invoices. If necessary, round the total number

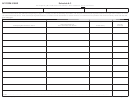

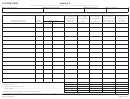

Specifi c Instructions for Schedule D

of ounces sold from all invoices to the whole ounce. Round partial

List each invoice on a separate line with the name of the retailer,

ounces of cavendish, plug, or twist up to the next highest ounce

the date and number of the invoice, and the number of items or

(i.e., round .1 oz. - .9 oz. up to 1 oz.). Round partial ounces of

total number of ounces returned, whichever is applicable.

smoking tobacco, snuff, fi ne cut chewing, etc. to the nearest ounce

(i.e., round .1 oz. - .4 oz. down to 0 oz., round .5 oz. - .9 oz. up to

Sum the total number of items returned and the total number of

1 oz.). Enter totals here.

ounces returned from all invoices. If necessary, round the total

number of ounces returned from all invoices to the whole ounce.

Line 2: Calculate the number of items and number of ounces from

Round partial ounces of cavendish, plug, or twist up to the next

line 1 that were sold tax free. Enter totals here.

highest ounce (i.e., round .1 oz. - .9 oz. up to 1 oz.). Round partial

Line 3: Multiply the totals on line 2 by the total tax rates. Enter

ounces of smoking tobacco, snuff, fi ne cut chewing, etc. to the

amounts here.

nearest ounce (i.e., round .1 oz. - .4 oz. down to 0 oz., round .5 oz.

Line 4: Calculate the number of items and number of ounces from

- .9 oz. up to 1 oz.).

line 1 that were sold for which the §42-3251 and §42-3251.01 tax

Multiply the total number of items and the total number of ounces

rates were collected. Enter totals here.

returned during the month by the total tax rate to calculate the “Net

Line 5: Multiply the totals on line 4 by the §42-3052 tax rates.

amount to be deducted for returned product this month.”

Enter amounts here.

Sum the “Net amount to be deducted for returned product this

Line 6: Add amounts from lines 3 and 5. Enter total here.

month” to calculate the “Total amount to be deducted for returned

product this month”. Enter this amount on page 1, line 6.

For “-2” retailers, enter the registration number, name, invoice

date and number, and the total number of items or total number of

Certifi cation of No Nonparticipating

ounces sold, whichever is applicable. Do not round ounces of

individual packages.

Manufacturers Activity

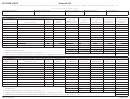

Line 7: Sum the total number of items sold and the total number of

If you have not engaged in any activity required to be reported on

ounces sold from all invoices. If necessary, round the total number

Form 819, Schedule A-2 or A-4, Form 800-20, Schedule A-2 or

of ounces sold from all invoices to the whole ounce. Round partial

A-4, or Form 800-25, Schedule A-2 or A-4 during the applicable

ounces of cavendish, plug, or twist up to the next highest ounce

period, complete and submit the form, Nonresident Distributor’s

(i.e., round .1 oz. - .9 oz. up to 1 oz.). Round partial ounces of

Certifi cation of No Nonparticipating Manufacturers Activity (In Lieu

smoking tobacco, snuff, fi ne cut chewing, etc. to the nearest ounce

of Nonparticipating Manufacturers Schedules).

(i.e., round .1 oz. - .4 oz. down to 0 oz., round .5 oz. - .9 oz. up to

1 oz.). Enter totals here.

Line 8: Calculate the number of items and number of ounces from

line 7 that were sold tax free. Enter totals here.

Page 17 of 17

ADOR 14-5322 (8/05)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17