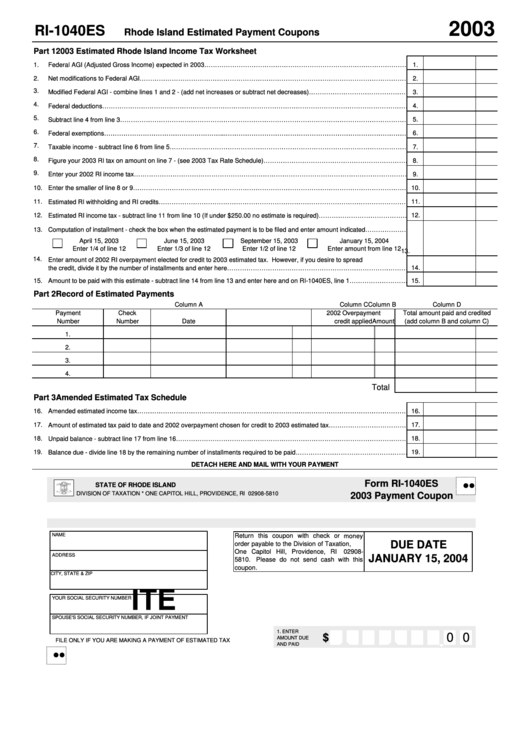

Form Ri-1040es - Rhode Island Estimated Payment Coupons

ADVERTISEMENT

2003

RI-1040ES

Rhode Island Estimated Payment Coupons

Part 1

2003 Estimated Rhode Island Income Tax Worksheet

1.

Federal AGI (Adjusted Gross Income) expected in 2003……………………………………………………………………………………………………………………..

1.

2.

Net modifications to Federal AGI…………………………………………………………………………………………………………………….

2.

3.

Modified Federal AGI - combine lines 1 and 2 - (add net increases or subtract net decreases)……………………………………………………………………………………………

3.

4.

Federal deductions……………………………………………………………………………………………………………………………………………

4.

5.

Subtract line 4 from line 3……………………………………………………………………………………………………………………………….

5.

6.

Federal exemptions………………………………………………...…………………………………………………………………………………………

6.

7.

Taxable income - subtract line 6 from line 5…………………………………………………………………………………………………………………..

7.

8.

Figure your 2003 RI tax on amount on line 7 - (see 2003 Tax Rate Schedule)……………………………………………………………………………………………………………..

8.

9.

Enter your 2002 RI income tax……………………………………………………………………………………………………………………………

9.

10. Enter the smaller of line 8 or 9…………………………………………………………………………………………………………………………..

10.

11. Estimated RI withholding and RI credits……………………………………………………………………………………………………………………………………………

11.

12. Estimated RI income tax - subtract line 11 from line 10 (If under $250.00 no estimate is required)………………………………………………………………

12.

13. Computation of installment - check the box when the estimated payment is to be filed and enter amount indicated………………………………………………………………..

April 15, 2003

June 15, 2003

September 15, 2003

January 15, 2004

Enter 1/4 of line 12

Enter 1/3 of line 12

Enter 1/2 of line 12

Enter amount from line 12

13.

14.

Enter amount of 2002 RI overpayment elected for credit to 2003 estimated tax. However, if you desire to spread

14.

the credit, divide it by the number of installments and enter here………………………………………………………………………………….

15. Amount to be paid with this estimate - subtract line 14 from line 13 and enter here and on RI-1040ES, line 1……………………………………………………………………………

15.

Part 2

Record of Estimated Payments

Column A

Column B

Column C

Column D

Payment

Check

2002 Overpayment

Total amount paid and credited

Number

Number

Date

Amount

credit applied

(add column B and column C)

1.

2.

3.

4.

Total

Part 3

Amended Estimated Tax Schedule

16. Amended estimated income tax………………………………………………………………………………………………………………………………………….

16.

17. Amount of estimated tax paid to date and 2002 overpayment chosen for credit to 2003 estimated tax……………………………………………………………………………

17.

18. Unpaid balance - subtract line 17 from line 16…………………………………………………………………………………………………………………………………………..

18.

19. Balance due - divide line 18 by the remaining number of installments required to be paid……………………………………………………………

19.

DETACH HERE AND MAIL WITH YOUR PAYMENT

Form RI-1040ES

l l

STATE OF RHODE ISLAND

DIVISION OF TAXATION * ONE CAPITOL HILL, PROVIDENCE, RI 02908-5810

2003 Payment Coupon

NAME

Return this coupon with check or money

DUE DATE

order payable to the R.I. Division of Taxation,

One Capitol Hill, Providence, RI 02908-

ADDRESS

JANUARY 15, 2004

5810. Please do not send cash with this

coupon.

CITY, STATE & ZIP

ITE

YOUR SOCIAL SECURITY NUMBER

SPOUSE'S SOCIAL SECURITY NUMBER, IF JOINT PAYMENT

1. ENTER

0 0

$

AMOUNT DUE

FILE ONLY IF YOU ARE MAKING A PAYMENT OF ESTIMATED TAX

AND PAID

l l

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2