Schedule D Individual - Capital Assets Gains And Losses Form - 2005 Page 3

ADVERTISEMENT

Rev. 05.05

Schedule D Individual - Page 3

Taxpayer's name

Social Security Number

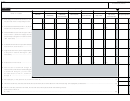

Part VII

53

Net Capital Gains or Losses and Distributions from Qualified Pension Plans for Determination of the Adjusted Gross Income

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Column H

Gains or Losses

Property Located

Shares from Elig.

Property Located

Other Properties

Shares from Elig.

in Puerto Rico

Other Properties

Corp. or Part.

Under Special Legislation

Short-Term

in Puerto Rico

(Act No. 226 of 2004)

Corp. or Part.

(Act No. 226 of 2004)

(Act No. 226 of 2004)

40.

Enter the gains determined on lines 11, 20,

00

00

00

00

(01)

00

00

00

00

28, 35 and 36 in the corresponding Column ..

41.

Enter the losses determined on lines 11, 20, 28, 35

(03)

(02)

00

(05)

(07)

(09)

00

(13)

(15)

00

00

(11)

00

00

00

00

and 36 in the corresponding Column .............…..

42.

If one or more of Columns B through H reflect

a loss on line 41, add them and apply the total

proportionally to the gains in the other Columns

00

00

00

00

00

00

00

(See instructions) ......................................

43.

Subtract line 42 from line 40. If any Column reflected

00

00

00

00

00

00

00

a loss on line 41, enter zero here ........................

44.

Apply the loss from line 41, Column A proportionally

to the gains in Columns B through H. (See

00

00

00

00

00

00

00

instructions) ...................................................

(04)

00

(06)

00

(08)

00

(10)

(14)

(16)

00

00

00

00

45.

Subtract line 44 from line 43 ........................

(12)

46.

Add the total of Columns B through H,

line 45. However, if line 40 does not reflect any gain

in Columns B through H, you must enter

the total amount of line 41, Columns A

(17)

00

through H ..............................................

00

47.

Net capital gain (or loss) (Add line 40, Column A and line 46) .................................................................................................…….............................................................................................……

(18)

00

48.

If line 47 is more than zero, enter here and in Part 2, line 2 Q of the return, the sum of lines 39 and 47. If line 47 includes long - term capital gains, see instructions .......…......................................................................…….

(19)

49.

If line 47 is a net loss, enter here and in Part 2, line 2 Q of the return, line 39 plus the smaller of the following amounts:

a) The net loss on line 47, or

00

b) (1,000) ..…………….......................................................................................................................……………............…........................................................................................…………..

(20)

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3