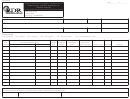

SUPPLIER NOTIFICATION OF UNCOLLECTIBLE TAX

Instructions

This form is to be completed when notifying the director of failure to collect tax from an eligible purchaser.

Fuel Codes

065 — Gasoline

142 — Kerosene

284 — Bio-Diesel – Undyed B100

123 — Alcohol

130 — Jet Fuel

285 — Soy Oil

241 — Ethanol

072 — Dyed Kerosene

290 — Bio-Diesel – Dyed B100

124 — Gasohol

160 — Diesel Fuel

122 — Blending Components

125 — Aviation Gasoline

228 — Dyed Diesel Fuel

(Identify) ______________________

General Instructions

Supplier name, address, license number and FEIN —

Enter the name, numbers and address information for the supplier.

Eligible Purchaser name, address, license number, and FEIN — Enter the name, numbers and address information of the defaulting eligible

purchaser.

Transaction Information —

Enter the requested information identifying the transactions on which tax

was not remitted by the eligible purchaser.

Sign and date the form.

Notification of uncollectible tax must be submitted within ten (10) business days following the earliest date on which the supplier was entitled

to collect the tax from the eligible purchase. Failure to provide notification within the specified period will result in credit being disallowed.

The credit is to be claimed by completing an Affidavit For Bad Debt Loss (Form 8A) and returning it with the first return following the expiration

of the ten-day period.

Credit is limited to the amount of tax and fees due from the purchaser, including any accruals within the ten (10) day notification period.

If you have questions or need assistance in completing this form, please call (573) 751-2611 or e-mail excise@dor.mo.gov. You may also

access the department’s web site at to obtain this form.

MO 860-2839 (11-2006)

DOR-4760 (11-2006)

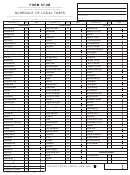

SUPPLIER NOTIFICATION OF UNCOLLECTIBLE TAX

Instructions

This form is to be completed when notifying the director of failure to collect tax from an eligible purchaser.

Fuel Codes

065 — Gasoline

142 — Kerosene

284 — Bio-Diesel – Undyed B100

123 — Alcohol

130 — Jet Fuel

285 — Soy Oil

241 — Ethanol

072 — Dyed Kerosene

290 — Bio-Diesel – Dyed B100

124 — Gasohol

160 — Diesel Fuel

122 — Blending Components

125 — Aviation Gasoline

228 — Dyed Diesel Fuel

(Identify) ______________________

General Instructions

Supplier name, address, license number and FEIN —

Enter the name, numbers and address information for the supplier.

Eligible Purchaser name, address, license number, and FEIN — Enter the name, numbers and address information of the defaulting eligible

purchaser.

Transaction Information —

Enter the requested information identifying the transactions on which tax

was not remitted by the eligible purchaser.

Sign and date the form.

Notification of uncollectible tax must be submitted within ten (10) business days following the earliest date on which the supplier was entitled

to collect the tax from the eligible purchase. Failure to provide notification within the specified period will result in credit being disallowed.

The credit is to be claimed by completing an Affidavit For Bad Debt Loss (Form 8A) and returning it with the first return following the expiration

of the ten-day period.

Credit is limited to the amount of tax and fees due from the purchaser, including any accruals within the ten (10) day notification period.

If you have questions or need assistance in completing this form, please call (573) 751-2611 or e-mail excise@dor.mo.gov. You may also

access the department’s web site at to obtain this form.

MO 860-2839 (11-2006)

DOR-4760 (11-2006)

1

1 2

2