Form Stec-Mpu - 2005 - Sales And Use Tax Multiple Points Of Use Exemption Certificate -Ohio Department Of Taxation

ADVERTISEMENT

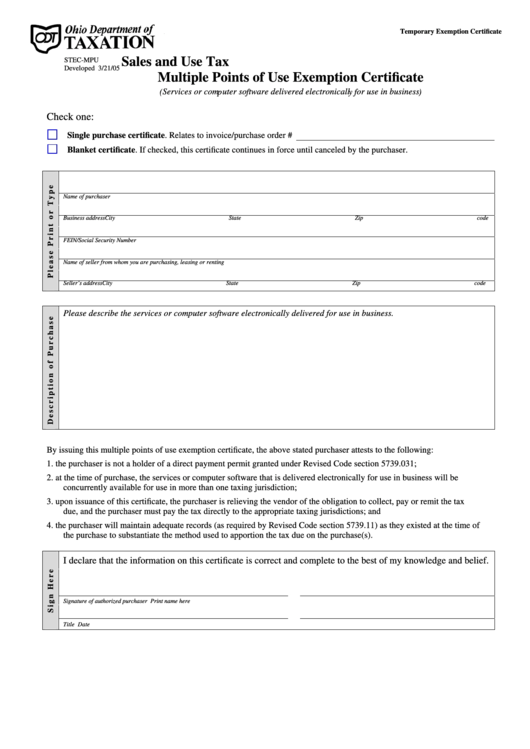

Temporary Exemption Certificate

Sales and Use Tax

STEC-MPU

Developed 3/21/05

Multiple Points of Use Exemption Certificate

(Services or computer software delivered electronically for use in business)

Check one:

Single purchase certificate. Relates to invoice/purchase order #

Blanket certificate. If checked, this certificate continues in force until canceled by the purchaser.

Name of purchaser

Business address

City

State

Zip code

FEIN/Social Security Number

Name of seller from whom you are purchasing, leasing or renting

Seller’s address

City

State

Zip code

Please describe the services or computer software electronically delivered for use in business.

By issuing this multiple points of use exemption certificate, the above stated purchaser attests to the following:

1. the purchaser is not a holder of a direct payment permit granted under Revised Code section 5739.031;

2. at the time of purchase, the services or computer software that is delivered electronically for use in business will be

concurrently available for use in more than one taxing jurisdiction;

3. upon issuance of this certificate, the purchaser is relieving the vendor of the obligation to collect, pay or remit the tax

due, and the purchaser must pay the tax directly to the appropriate taxing jurisdictions; and

4. the purchaser will maintain adequate records (as required by Revised Code section 5739.11) as they existed at the time of

the purchase to substantiate the method used to apportion the tax due on the purchase(s).

I declare that the information on this certificate is correct and complete to the best of my knowledge and belief.

Signature of authorized purchaser

Print name here

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1