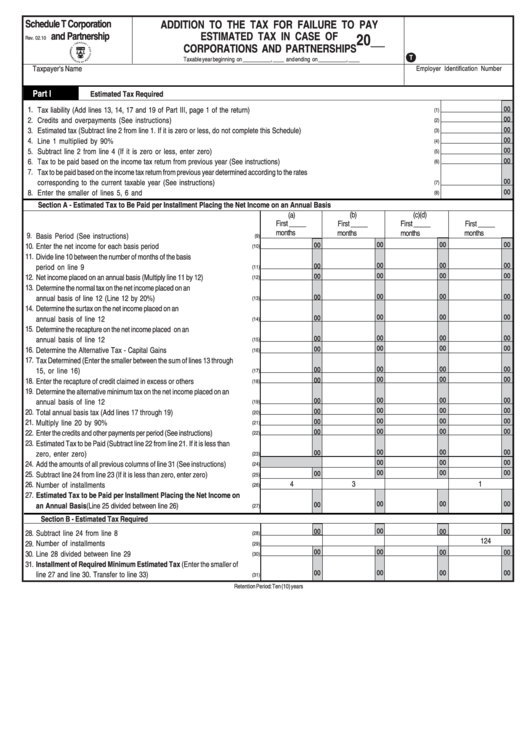

Schedule T Corporation And Partnership - Addition To The Tax For Failure To Pay Estimated Tax In Case Of Corporations And Partnerships

ADVERTISEMENT

Schedule T Corporation

ADDITION TO THE TAX FOR FAILURE TO PAY

ESTIMATED TAX IN CASE OF

and Partnership

20__

Rev. 02.10

CORPORATIONS AND PARTNERSHIPS

T

Taxable year beginning on __________, ____ and ending on __________, ____

Taxpayer's Name

Employer Identification Number

Part I

Estimated Tax Required

1.

00

Tax liability (Add lines 13, 14, 17 and 19 of Part III, page 1 of the return) ....................................................................................................

(1)

00

2.

Credits and overpayments (See instructions) .........................................................................................................................................

(2)

3.

Estimated tax (Subtract line 2 from line 1. If it is zero or less, do not complete this Schedule) ........................................................................

00

(3)

4.

00

Line 1 multiplied by 90% ....................................................................................................................................................................

(4)

00

5.

Subtract line 2 from line 4 (If it is zero or less, enter zero) .........................................................................................................................

(5)

6.

00

Tax to be paid based on the income tax return from previous year (See instructions) ....................................................................................

(6)

7.

Tax to be paid based on the income tax return from previous year determined according to the rates

corresponding to the current taxable year (See instructions) .....................................................................................................................

00

(7)

8.

00

Enter the smaller of lines 5, 6 and 7.......................................................................................................................................................

(8)

Section A - Estimated Tax to Be Paid per Installment Placing the Net Income on an Annual Basis

(b)

(c)

(d)

(a)

First _____

First _____

First _____

First _____

months

months

months

months

9.

Basis Period (See instructions) .................................................................

(9)

00

00

00

10.

00

Enter the net income for each basis period ..................................................

(10)

11.

Divide line 10 between the number of months of the basis

00

00

00

00

period on line 9 .......................................................................................

(11)

00

00

00

00

12.

Net income placed on an annual basis (Multiply line 11 by 12) ..........................

(12)

13.

Determine the normal tax on the net income placed on an

00

00

00

00

annual basis of line 12 (Line 12 by 20%) ...................................................

(13)

14.

Determine the surtax on the net income placed on an

00

00

00

00

annual basis of line 12 .............................................................................

(14)

15.

Determine the recapture on the net income placed on an

00

00

00

00

annual basis of line 12 .............................................................................

(15)

00

00

00

16.

00

Determine the Alternative Tax - Capital Gains .............................................

(16)

17.

Tax Determined (Enter the smaller between the sum of lines 13 through

00

00

00

00

15, or line 16) .....................................................................................

(17)

00

00

00

00

18.

Enter the recapture of credit claimed in excess or others ..............................

(18)

19.

Determine the alternative minimum tax on the net income placed on an

00

00

00

00

annual basis of line 12 .............................................................................

(19)

00

00

00

00

20.

Total annual basis tax (Add lines 17 through 19) ..........................................

(20)

00

00

00

21.

00

Multiply line 20 by 90% ..........................................................................

(21)

00

00

00

00

22.

Enter the credits and other payments per period (See instructions) ......................

(22)

23.

Estimated Tax to be Paid (Subtract line 22 from line 21. If it is less than

00

00

00

00

zero, enter zero) ....................................................................................

(23)

00

00

00

24.

Add the amounts of all previous columns of line 31 (See instructions) ............

(24)

00

00

00

25.

00

Subtract line 24 from line 23 (If it is less than zero, enter zero) .......................

(25)

4

3

2

1

26.

Number of installments ............................................................................

(26)

27.

Estimated Tax to be Paid per Installment Placing the Net Income on

00

00

00

00

an Annual Basis (Line 25 divided between line 26) ........................................

(27)

Section B - Estimated Tax Required

00

00

00

00

28.

Subtract line 24 from line 8 ......................................................................

(28)

4

3

2

1

29.

Number of installments ...........................................................................

(29)

00

00

00

00

30.

Line 28 divided between line 29 ...............................................................

(30)

Installment of Required Minimum Estimated Tax (Enter the smaller of

31.

00

00

00

00

line 27 and line 30. Transfer to line 33) ......................................................

(31)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2