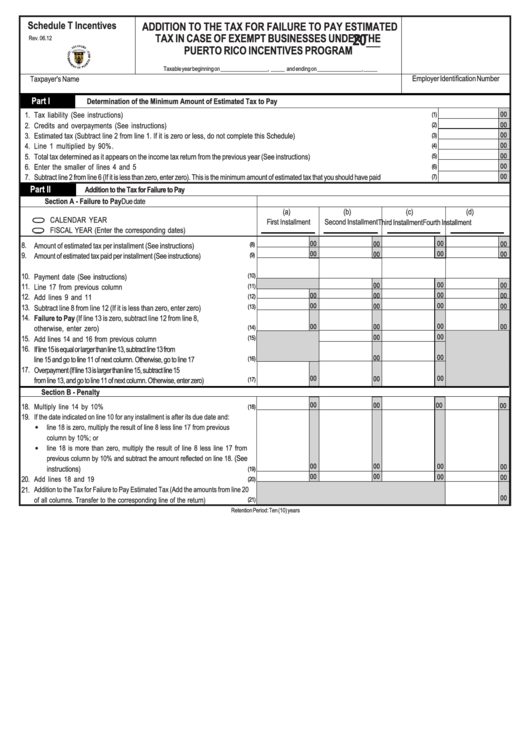

Schedule T Incentives - Addition To The Tax For Failure To Pay Estimated Tax In Case Of Exempt Businesses Under The Puerto Rico Incentives Program

ADVERTISEMENT

Schedule T Incentives

ADDITION TO THE TAX FOR FAILURE TO PAY ESTIMATED

20__

TAX IN CASE OF EXEMPT BUSINESSES UNDER THE

Rev. 06.12

PUERTO RICO INCENTIVES PROGRAM

Taxable year beginning on _________________, _____ and ending on ________________, _____

Taxpayer's Name

Employer Identification Number

Part I

Determination of the Minimum Amount of Estimated Tax to Pay

00

1.

Tax liability (See instructions) .................................................................................................................................................................

(1)

00

2.

Credits and overpayments (See instructions) ...........................................................................................................................................

(2)

3.

Estimated tax (Subtract line 2 from line 1. If it is zero or less, do not complete this Schedule) ..........................................................................

00

(3)

4.

Line 1 multiplied by 90%. ...............................................................................................................................................................

00

(4)

5.

Total tax determined as it appears on the income tax return from the previous year (See instructions) ..................................................................

00

(5)

00

6.

Enter the smaller of lines 4 and 5 ............................................................................................................................................................

(6)

00

7.

Subtract line 2 from line 6 (If it is less than zero, enter zero). This is the minimum amount of estimated tax that you should have paid ............................

(7)

Part II

Addition to the Tax for Failure to Pay

Due date

Section A - Failure to Pay

(a)

(b)

(c)

(d)

CALENDAR YEAR ...........................................................................

First Installment

Second Installment

Third Installment

Fourth Installment

FISCAL YEAR (Enter the corresponding dates) ......................................

00

00

00

00

8.

Amount of estimated tax per installment (See instructions) .............................

(8)

00

00

00

00

9.

Amount of estimated tax paid per installment (See instructions) ...........................

(9)

10.

Payment date (See instructions) ..................................................................

(10)

00

00

00

11.

Line 17 from previous column ...................................................................

(11)

00

00

00

00

12.

Add lines 9 and 11 ..................................................................................

(12)

00

00

00

00

13.

Subtract line 8 from line 12 (If it is less than zero, enter zero) .........................

(13)

14.

Failure to Pay (If line 13 is zero, subtract line 12 from line 8,

00

00

00

00

otherwise, enter zero) ..............................................................................

(14)

00

00

15.

Add lines 14 and 16 from previous column .................................................

(15)

16.

If line 15 is equal or larger than line 13, subtract line 13 from

00

00

line 15 and go to line 11 of next column. Otherwise, go to line 17 ..................................

(16)

17.

Overpayment (If line 13 is larger than line 15, subtract line 15

00

00

00

from line 13, and go to line 11 of next column. Otherwise, enter zero) ............................

(17)

Section B - Penalty

00

00

00

00

18.

Multiply line 14 by 10% ............................................................................

(18)

19.

If the date indicated on line 10 for any installment is after its due date and:

•

line 18 is zero, multiply the result of line 8 less line 17 from previous

column by 10%; or

•

line 18 is more than zero, multiply the result of line 8 less line 17 from

previous column by 10% and subtract the amount reflected on line 18. (See

00

00

00

00

instructions) ..............................................................................................

(19)

00

00

00

00

20.

Add lines 18 and 19 .................................................................................

(20)

21.

Addition to the Tax for Failure to Pay Estimated Tax (Add the amounts from line 20

00

of all columns. Transfer to the corresponding line of the return) .......................

(21)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1