Form Liq-1 - Liquor Excise Tax Return-Nevada Department Of Taxation

ADVERTISEMENT

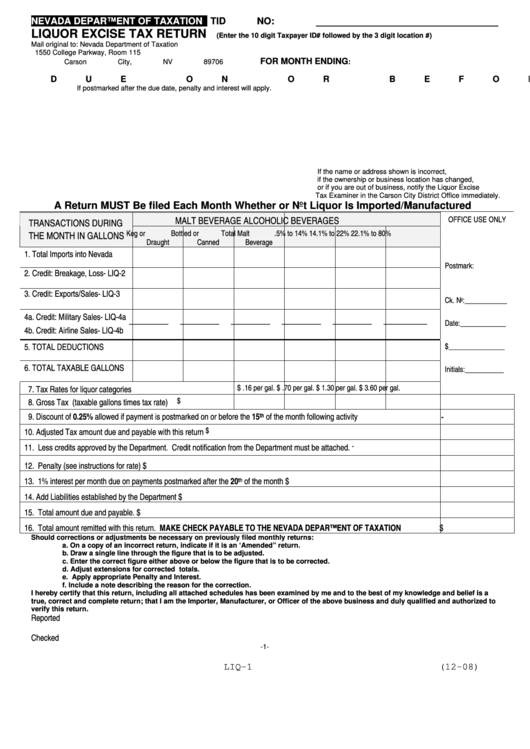

NEVADA DEPARTMENT OF TAXATION

TID NO:

LIQUOR EXCISE TAX RETURN

(Enter the 10 digit Taxpayer ID# followed by the 3 digit location #)

Mail original to:

Nevada Department of Taxation

1550 College Parkway, Room 115

FOR MONTH ENDING

Carson City, NV 89706

:

DUE ON OR BEFORE:

If postmarked after the due date, penalty and interest will apply.

If the name or address shown is incorrect,

if the ownership or business location has changed,

or if you are out of business, notify the Liquor Excise

Tax Examiner in the Carson City District Office immediately.

A Return MUST Be filed Each Month Whether or Not Liquor Is Imported/Manufactured

MALT BEVERAGE

ALCOHOLIC BEVERAGES

OFFICE USE ONLY

TRANSACTIONS DURING

Keg or

Bottled or

Total Malt

.5% to 14%

14.1% to 22%

22.1% to 80%

THE MONTH IN GALLONS

Draught

Canned

Beverage

1. Total Imports into Nevada

Postmark:

2. Credit: Breakage, Loss- LIQ-2

3. Credit: Exports/Sales- LIQ-3

Ck. No:____________

4a. Credit: Military Sales- LIQ-4a

_________

_________

_________

_________

_________

__________

Date:_____________

4b. Credit: Airline Sales- LIQ-4b

$________________

5. TOTAL DEDUCTIONS

Initials:___________

6. TOTAL TAXABLE GALLONS

$ .16 per gal.

$ .70 per gal.

$ 1.30 per gal.

$ 3.60 per gal.

7. Tax Rates for liquor categories

$

8. Gross Tax (taxable gallons times tax rate)

-

9. Discount of 0.25% allowed if payment is postmarked on or before the 15

of the month following activity

th

$

10. Adjusted Tax amount due and payable with this return

-

11. Less credits approved by the Department. Credit notification from the Department must be attached.

12. Penalty (see instructions for rate)

$

13. 1% interest per month due on payments postmarked after the 20

of the month

$

th

14. Add Liabilities established by the Department

$

15. Total amount due and payable.

$

16. Total amount remitted with this return. MAKE CHECK PAYABLE TO THE NEVADA DEPARTMENT OF TAXATION

$

Should corrections or adjustments be necessary on previously filed monthly returns:

a.

On a copy of an incorrect return, indicate if it is an ‘Amended” return.

b.

Draw a single line through the figure that is to be adjusted.

c.

Enter the correct figure either above or below the figure that is to be corrected.

d.

Adjust extensions for corrected totals.

e.

Apply appropriate Penalty and Interest.

f.

Include a note describing the reason for the correction.

I hereby certify that this return, including all attached schedules has been examined by me and to the best of my knowledge and belief is a

true, correct and complete return; that I am the Importer, Manufacturer, or Officer of the above business and duly qualified and authorized to

verify this return.

Reported By....................................................................................

Signed ..................................................................................................................

Checked by....................................................................................... Title ......................................... Phone No........................................................

-1-

LIQ-1

(12-08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5