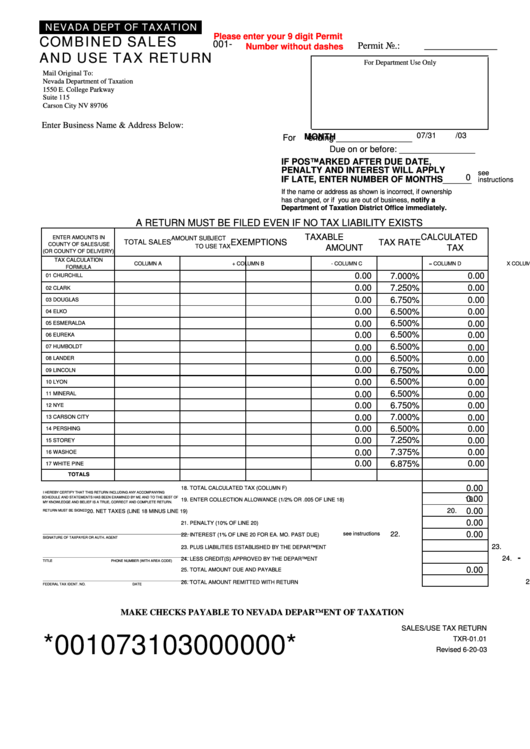

NEVADA DEPT OF TAXATION

COMBINED SALES

Please enter your 9 digit Permit

001-

Permit No.:

_______________

Number without dashes

AND USE TAX RETURN

For Department Use Only

Mail Original To:

Nevada Department of Taxation

1550 E. College Parkway

Suite 115

Carson City NV 89706

Enter Business Name & Address Below:

07/31

/03

MONTH

For

ending ________________

Due on or before: ________________

IF POSTMARKED AFTER DUE DATE,

PENALTY AND INTEREST WILL APPLY

see

0

IF LATE, ENTER NUMBER OF MONTHS______

instructions

If the name or address as shown is incorrect, if ownership

has changed, or if you are out of business, notify a

Department of Taxation District Office immediately.

A RETURN MUST BE FILED EVEN IF NO TAX LIABILITY EXISTS

TAXABLE

CALCULATED

ENTER AMOUNTS IN

AMOUNT SUBJECT

EXEMPTIONS

TAX RATE

TOTAL SALES

COUNTY OF SALES/USE

TO USE TAX

AMOUNT

TAX

(OR COUNTY OF DELIVERY)

TAX CALCULATION

COLUMN A

+ COLUMN B

- COLUMN C

= COLUMN D

X COLUMN E

= COLUMN F

FORMULA

0.00

7.000%

0.00

01 CHURCHILL

0.00

0.00

7.250%

02 CLARK

0.00

0.00

6.750%

03 DOUGLAS

0.00

6.500%

0.00

04 ELKO

0.00

6.500%

0.00

05 ESMERALDA

0.00

6.500%

0.00

06 EUREKA

6.500%

0.00

0.00

07 HUMBOLDT

6.500%

0.00

0.00

08 LANDER

0.00

6.750%

0.00

09 LINCOLN

6.500%

0.00

0.00

10 LYON

0.00

6.500%

0.00

11 MINERAL

0.00

6.750%

0.00

12 NYE

7.000%

0.00

0.00

13 CARSON CITY

0.00

6.500%

0.00

14 PERSHING

7.250%

0.00

0.00

15 STOREY

7.375%

0.00

0.00

16 WASHOE

0.00

6.875%

0.00

17 WHITE PINE

TOTALS

0.00

18.

18. TOTAL CALCULATED TAX (COLUMN F)

I HEREBY CERTIFY THAT THIS RETURN INCLUDING ANY ACCOMPANYING

0.00

SCHEDULE AND STATEMENTS HAS BEEN EXAMINED BY ME AND TO THE BEST OF

19.

19. ENTER COLLECTION ALLOWANCE (1/2% OR .005 OF LINE 18)

MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN.

0.00

20.

RETURN MUST BE SIGNED

20. NET TAXES (LINE 18 MINUS LINE 19)

0.00

21.

21. PENALTY (10% OF LINE 20)

________________________________________________________________________

0.00

22.

22. INTEREST (1% OF LINE 20 FOR EA. MO. PAST DUE)

see instructions

SIGNATURE OF TAXPAYER OR AUTH. AGENT

23.

23. PLUS LIABILITIES ESTABLISHED BY THE DEPARTMENT

________________________________________________________________________

-

24.

24. LESS CREDIT(S) APPROVED BY THE DEPARTMENT

TITLE

PHONE NUMBER (WITH AREA CODE)

0.00

25.

25. TOTAL AMOUNT DUE AND PAYABLE

_________________________________________________________________________

26.

26. TOTAL AMOUNT REMITTED WITH RETURN

FEDERAL TAX IDENT. NO.

DATE

MAKE CHECKS PAYABLE TO NEVADA DEPARTMENT OF TAXATION

SALES/USE TAX RETURN

*001073103000000*

TXR-01.01

Revised 6-20-03

1

1