Form Fp-129a - Extension Of Time To File Dc Personal Property Tax Return - Instructions

ADVERTISEMENT

1

1

2

1

1

1

1

1

1

1

1

1

1

2

2

2

2

2

2

2

2

2

2

3

3

3

3

3

3

3

3

3

3

4

4

4

4

4

4

4

4

4

4

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

6

6

7

7

7

7

7

7

7

7

7

7

8

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

2

8

9

0

1

2

3

4

5

3

3

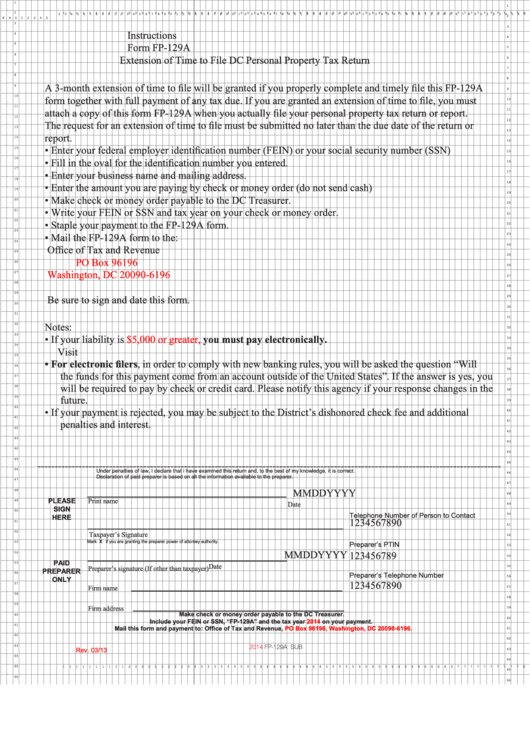

Instructions

4

4

Form FP-129A

5

5

6

Extension of Time to File DC Personal Property Tax Return

6

7

7

8

8

A 3-month extension of time to file will be granted if you properly complete and timely file this FP-129A

9

9

10

form together with full payment of any tax due. If you are granted an extension of time to file, you must

10

11

attach a copy of this form FP-129A when you actually file your personal property tax return or report.

11

12

12

The request for an extension of time to file must be submitted no later than the due date of the return or

13

13

report.

14

14

•

Enter your federal employer identification number (FEIN) or your social security number (SSN)

15

15

16

•

Fill in the oval for the identification number you entered.

16

17

•

Enter your business name and mailing address.

17

18

18

•

Enter the amount you are paying by check or money order (do not send cash)

19

19

•

Make check or money order payable to the DC Treasurer.

20

20

•

Write your FEIN or SSN and tax year on your check or money order.

21

21

22

•

Staple your payment to the FP-129A form.

22

23

•

Mail the FP-129A form to the:

23

24

24

Office of Tax and Revenue

25

25

PO Box 96196

26

26

Washington, DC 20090-6196

27

27

28

28

29

Be sure to sign and date this form.

29

30

30

31

31

Notes:

32

32

33

you must pay electronically.

•

If your liability is

$5,000 or greater,

33

34

Visit

34

35

35

•

For electronic filers, in order to comply with new banking rules, you will be asked the question “Will

36

36

the funds for this payment come from an account outside of the United States”. If the answer is yes, you

37

37

will be required to pay by check or credit card. Please notify this agency if your response changes in the

38

38

future.

39

39

40

•

If your payment is rejected, you may be subject to the District’s dishonored check fee and additional

40

41

penalties and interest.

41

42

42

43

43

44

44

45

----------------------------------------------------------------------------------------------------------------------------------------

45

46

Under penalties of law, I declare that i have examined this return and, to the best of my knowledge, it is correct.

46

Declaration of paid preparer is based on all the information available to the preparer.

47

47

MMDDYYYY

48

48

Print name

PLEASE

49

Date

49

SIGN

50

Telephone Number of Person to Contact

50

HERE

1234567890

51

51

52

Taxpayer’s Signature

52

Mark X if you are granting the preparer power of attorney authority.

53

Preparer’s PTIN

53

MMDDYYYY

123456789

54

54

PAID

55

Date

55

Preparer’s signature (If other than taxpayer)

PREPARER

56

Preparer’s Telephone Number

56

ONLY

1234567890

57

Firm name

57

58

58

59

Firm address

59

Make check or money order payable to the DC Treasurer.

60

60

Include your FEIN or SSN, “FP-129A” and the tax year

2014

on your payment.

61

Mail this form and payment to: Office of Tax and Revenue,

PO Box 96196, Washington, DC 20090-6196.

61

62

62

63

2014

FP-129A SUB

Rev. 03/13

63

64

64

65

1

1

1

1

1

1

1

1

1

1

2

2

2

2

2

2

2

2

2

2

3

3

3

3

3

3

3

3

3

3

4

4

4

4

4

4

4

4

4

4

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

6

6

7

7

7

7

7

7

7

7

7

7

8

65

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1