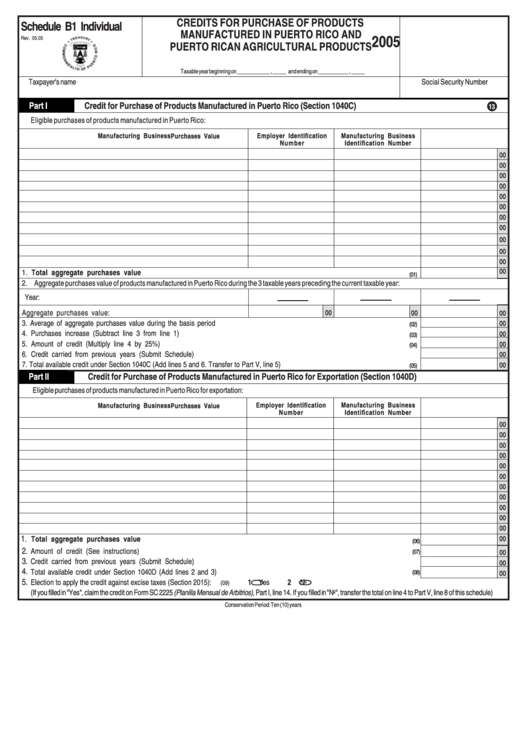

Schedule B1 Individual - Credits For Purchase Of Products Manufactured In Puerto Rico And Puerto Rican Agricultural Products - 2005

ADVERTISEMENT

CREDITS FOR PURCHASE OF PRODUCTS

Schedule B1 Individual

MANUFACTURED IN PUERTO RICO AND

2005

Rev. 05.05

PUERTO RICAN AGRICULTURAL PRODUCTS

Taxable year beginning on ____________ , _____ and ending on ___________ , _____

Taxpayer's name

Social Security Number

Part I

Credit for Purchase of Products Manufactured in Puerto Rico (Section 1040C)

13

Eligible purchases of products manufactured in Puerto Rico:

Manufacturing Business

Employer Identification

Manufacturing Business

Purchases Value

Number

Identification Number

00

00

00

00

00

00

00

00

00

00

00

00

1. Total aggregate purchases value .........................................................................................................................................

(01)

2. Aggregate purchases value of products manufactured in Puerto Rico during the 3 taxable years preceding the current taxable year:

Year:

Aggregate purchases value:

00

00

00

3. Average of aggregate purchases value during the basis period ...........................................................................................................

00

(02)

4. Purchases increase (Subtract line 3 from line 1) ...............................................................................................................................

00

(03)

5. Amount of credit (Multiply line 4 by 25%) .......................................................................................................................................

00

(04)

6. Credit carried from previous years (Submit Schedule) ......................................................................................................................

00

7. Total available credit under Section 1040C (Add lines 5 and 6. Transfer to Part V, line 5) .......................................................................

00

(05)

Part II

Credit for Purchase of Products Manufactured in Puerto Rico for Exportation (Section 1040D)

Eligible purchases of products manufactured in Puerto Rico for exportation:

Manufacturing Business

Manufacturing Business

Employer Identification

Purchases Value

Identification Number

Number

00

00

00

00

00

00

00

00

00

00

00

1.

Total aggregate purchases value .........................................................................................................................................

00

(06)

2.

Amount of credit (See instructions) .................................................................................................................................................

(07)

00

3.

Credit carried from previous years (Submit Schedule) ......................................................................................................................

00

4.

Total available credit under Section 1040D (Add lines 2 and 3) ...........................................................................................................

(08)

00

5.

Election to apply the credit against excise taxes (Section 2015):

1

Yes

2

No

(09)

(If you filled in "Yes", claim the credit on Form SC 2225 (Planilla Mensual de Arbitrios), Part I, line 14. If you filled in "No", transfer the total on line 4 to Part V, line 8 of this schedule)

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related Categories

Parent category: Financial

1

1 2

2