Quarterly Premium And Wage Reports Instructions

ADVERTISEMENT

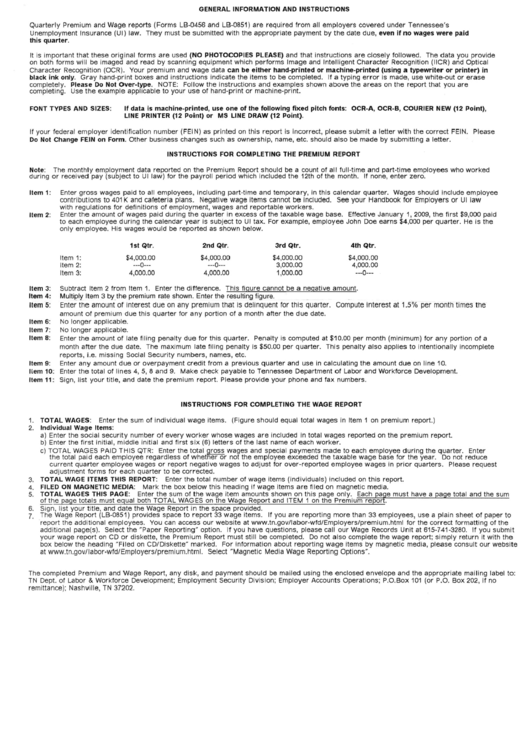

GENERAL INFORMATION AND INSTRUCTIONS

Quarterly Premium and Wage reports (Forms LB-0456 and LB-0851) are required from all employers covered under Tennessee's

Unemployment Insurance (UI) law. They must be submitted with the appropriate payment by the date due, even if no wages were paid

this quarter.

It is important that these original forms are used (NO PHOTOCOPIES PLEASE) and that instructions are closely followed. The data you provide

on both forms will be imaged and read by scanning equipment which performs Image and Intelligent Character Recognition (IICR) and Optical

Character Recognition (OCR). Your premium and wage data can be either hand-printed or machine-printed (using a typewriter or printer) in

black ink only. Gray hand-print boxes and instructions indicate the items to be completed. If a typing error is made, use white-out or erase

completely. Please Do Not Over-type. NOTE: Follow the instructions and examples shown above the areas on the report that you are

completing. Use the example applicable to your use of hand-print or machine-print.

FONT TYPES AND SIZES:

If data is machine-printed, use one of the following fixed pitch fonts: OCR-A, OCR-B, COURIER NEW (12 Point),

LINE PRINTER (12 Point) or MS LINE DRAW (12 Point).

If your federal employer identification number (FEIN) as printed on this report is incorrect, please submit a letter with the correct FEIN. Please

Do Not Change FEIN on Form. Other business changes such as ownership, name, etc. should also be made by submitting a letter.

INSTRUCTIONS FOR COMPLETING THE PREMIUM REPORT

Note:

The monthly employment data reported on the Premium Report should be a count of all full-time and part-time employees who worked

during or received pay (subject to UI law) for the payroll period which included the 12th of the month. If none, enter zero.

Item 1:

Enter gross wages paid to all employees, including part-time and temporary, in this calendar quarter. Wages should include employee

contributions to 401 K and cafeteria plans. Negative wage items cannot be included. See your Handbook for Employers or UI law

with regUlations for definitions of employment, wages and reportable workers.

Item 2:

Enter the amount of wages paid during the quarter in excess of the taxable wage base. Effective January 1, 2009, the first $9,000 paid

to each employee during the calendar year is SUbject to UI tax. For example, employee John Doe earns $4,000 per quarter. He is the

only employee. His wages would be reported as shown below.

1st Qtr.

2nd Qtr.

3rd Qtr.

4th Qtr.

Item 1:

$4,000.00

$4,000.00

$4,000.00

$4,000.00

Item 2:

---0---

---0---

3,000.00

4,000.00

Item 3:

4,000.00

4,000.00

1,000.00

---0--

Item 3:

Subtract Item 2 from Item 1. Enter the difference. This figure cannot be a negative amount.

Item 4:

MUltilJly Item 3 bythe premium rate shown. Enter the resulting figure.

Item 5:

Enter the amount of interest due on any premium that is delinquent for this quarter. Compute interest at 1.5% per month times the

amount of premium due this quarter for any portion of a month after the due date.

Item 6:

No longer applicable.

Item 7:

No longer applicable.

Item 8:

Enter the amount of late filing penalty due for this quarter. Penalty is computed at $10.00 per month (minimum) for any portion of a

month after the due date. The maximum late filing penalty is $50.00 per quarter. This penalty also applies to intentionally incomplete

reports, i.e. missing Social Security numbers, names, etc.

Item 9:

Enter any amount due or overpayment credit from a previous quarter and use in calculating the amount due on line 10.

Item 10: Enter the total of lines 4, 5, 8 and 9. Make check payable to Tennessee Department of Labor and Workforce Development.

Item 11: Sign, list your title, and date the premium report. Please provide your phone and fax numbers.

INSTRUCTIONS FOR COMPLETING THE WAGE REPORT

1. TOTAL WAGES:

Enter the sum of individual wage items. (Figure should equal total wages in Item 1 on premium report.)

2. Individual Wage Items:

a) Enter the social security number of every worker whose wages are included in total wages reported on the premium report.

b) Enter the first initial, middle initial and first six (6) letters of the last name of each worker.

c) TOTAL WAGES PAID THIS QTR: Enter the total woss wages and special payments made to each employee during the quarter. Enter

the total paid each empioyee regardless of whet er or not the employee exceeded the taxable wage base for the year. Do not reduce

current quarter employee wages or report negative wages to adjust for over-reported employee wages in prior quarters. Please request

adjustment forms for each quarter to be corrected.

3. TOTAL WAGE ITEMS THIS REPORT:

Enter the total number of wage items (individuals) included on this report.

4. FILED ON MAGNETIC MEDIA:

Mark the box below this heading if wage items are filed on magnetic media.

5. TOTAL WAGES THIS PAGE:

Enter the sum of the wage item amounts shown on this page only. Each

pa~e

must have a page total and the sum

of the page totals must equal both TOTAL WAGES on the Wage Report and ITEM 1 on the Premium repor .

6. Sign, list your title, and date the Wage Report in the space provided.

7. The Wage Report (LB-0851) provides space to report 33 wage items. If you are reporting more than 33 employees, use a plain sheet of paper to

report the additionai employees. You can access our website at the correct formatting of the

additional page(s). Select the "Paper Reporting" option. If you have questions, please call our Wage Records Unit at 615-741-3280. If you submit

your wage report on CD or diskette, the Premium Report must still be completed. Do not also complete the wage report; simply return it with the

box below the heading "Filed on CD/Diskette" marked. For information about reporting wage items by magnetic media, please consult our website

at Select "Magnetic Media Wage Reporting Options".

The completed Premium and Wage Report, any disk, and payment should be mailed using the enclosed envelope and the appropriate mailing label to:

TN Dept. of Labor & Workforce Development; Employment Security Division; Employer Accounts Operations; P.O.Box 101 (or P.O. Box 202, if no

remittance); Nashville, TN 37202.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1