BOE-65 (BACK) REV. 26 (8-09)

NOTICE OF CLOSEOUT FOR SELLER’S PERMIT

SECTION III: CHECKLIST INSTRUCTIONS

ALL CLOSEOUTS

Return your seller’s permit, if available–Your seller’s permit is the goldenrod document you received when you initially applied for

your Sales Tax Permit. If you are currently unable to locate this document but do so in the future, please destroy the permit.

Location of your books and records–The location of your books and records is important for audit purposes. Audits are important

because they protect the state against an underpayment of the sales tax and protect the taxpayer against an overpayment of the

sales tax.

Final Tax Return with Payment–If your final tax return is not available, please call 800-400-7115 between the hours of 8:00 a.m. and

5:00 p.m. Pacific time or contact your local BOE office. If you are required to make payments by EFT, you must also make your final

payment through the EFT process.

CLOSEOUT BECAUSE BUSINESS SOLD and/or SECURITY DEPOSIT IS BEING REFUNDED

Copy of your escrow instructions or bill of sale–These documents show the value of inventory, fixtures and equipment sold. The

sales price of your fixtures and equipment must be included on line 2 of your final return. If a sale of fixtures and equipment is not

considered at the date of closeout, a subsequent single sale of the fixtures may be treated as an occasional sale. The single sale of

fixtures and equipment subsequent to the date of closeout is taxable if either:

a. The sale occurs within 60 days of the date of closeout and the taxpayer cannot establish that the sale was not considered at the time

of closeout; or

b. The sale takes place after 60 days and within one year of the closeout date, and:

1. A contract of sale existed at the date of closeout, or

2. A lease with an option to buy exists, or

3. Arrangements have been made for a plan to sell the fixtures and equipment in due course.

You will need to provide information about your final two tax returns.

If you efiled, you only need to provide proof of payment.

If you filed paper tax returns, you must provide copies of the final two tax returns and proof of payment.

If these items are not provided, the BOE must wait 30 days before refunding any security deposits posted and/or closing your account.

Final payments–Payment of any amounts due must be made in certified funds in order to expedite finalizing your closeout transaction.

Accounts required to make their tax payments by EFT must also make their final payments through the EFT process.

If you need assistance in providing any of the items listed above, contact your nearest BOE office for detailed instructions. If the

items listed above do not pertain to your closeout and you have completed Sections I, II, and signed in Section IV, forward this

document to the appropriate BOE office. See publication 74 for a list of field office locations.

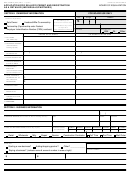

FOR BOE USE ONLY

Is registration information current?

YES

NO

F & E?

YES

NO

Is a final return filed?

YES

NO

Inventory?

YES

NO

Was a final return provided to taxpayer?

YES

NO

Is the documentation attached?

YES

NO

Are there any delinquencies?

YES

NO

1

1 2

2