Form 40a727 - Income Tax Forms Requisition Page 5

ADVERTISEMENT

KENTUCKY INCOME TAX

40A727 (10-07)

FROM: Department of Revenue

FORMS REQUISITION

Frankfort, KY

40620

The label at right will be used to mail your forms. Do not detach.

Please prepare a duplicate address below for our files.

TO:

Name

Name

Street

City, State

Street

and ZIP

City, State

Phone

(

)

and ZIP Code

Date Ordered

Check one:

Individual

Attorney

CPA

Tax Practitioner

Other

Package K (contains all individual, fiduciary, partnership, corporation

and S corporation income tax forms, schedules and instructions) .......................................... Quantity ➤

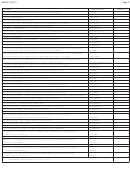

FORMS

I

N

C

S

ISSUANCE NO.

QUANTITY

740—Kentucky Individual Income Tax Return

42A740

740/740-EZ—Instructions

42A740-S11

740-EZ—Kentucky Individual Income Tax Return

42A740-EZ

740-X—Amended Kentucky Individual Income Tax Return for Tax Year 2005, 2006, 2007

42A740-X

740-XP—Amended Kentucky Individual Income Tax Return for Tax Year 2004 and Prior Years

42A740-XP

740-NP—Nonresident or Part-Year Resident Income Tax Return

42A740-S9

Schedules A & ME (740-NP)—Itemized Deductions/Moving Expense and Reimbursement

42A740-S9 (A & ME)

740-NP Packet

42A740-NP(P)

740-NP-R—Nonresident Income Tax Return—Reciprocal State

42A740-NP-R

740-ES—2008 Estimated Tax Voucher

42A740-ES

740-ES—Instructions

42A740-S4

Schedule A (740)—Itemized Deductions

42A740-A

Schedule J—Kentucky Farm Income Averaging

42A740-J

Schedule KNOL—Kentucky Net Operating Loss Schedule

42A740-KNOL

Schedule M—Kentucky Federal Adjusted Gross Income Modifications

42A740-M

Schedule P—Pension Income Exclusion

42A740-P

Schedule UTC—Unemployment Tax Credit

42A740-UTC

2210-K—Underpayment of Estimated Tax by Individuals

42A740-S1

4972-K—Kentucky Tax on Lump-Sum Distributions

42A740-S21

8453-K—Kentucky Individual Income Tax Declaration for Electronic Filing

42A740-S22

740-V—Kentucky Electronic Payment Voucher

42A740-S23

8582-K—Kentucky Passive Activity Loss Limitations

42A740-S18

8863-K—Kentucky Education Tuition Tax Credit

42A740-S24

Application for Extension of Time to File Return (Individual, General Partnership, Fiduciary)

40A102

Total Forms—Pages 1 and 2 ...................................... ➤

Package K

x $9.00 (includes UPS shipping) .................................................

No Charge

Up to 250 Forms ................................................................................................................................

$15.00

251 Forms (flat rate) ..........................................................................................................................

Over 251 (quantity)

x $.05 each .....................................................................

ENVELOPES (Available in groups of 100 only)

Refund 6" x 9" Blue —Enter number of groups here ........................... ➤

Payment 6" x 9" Yellow—Enter number of groups here ..................... ➤

Envelopes

x $5.00 per group of 100 ........................................................

Subtotal ...........................................................................

Sales Tax (6%) (Kentucky residents only) ....................

Forms Cost Schedule

TOTAL ........................................................................... ➤

Up to 250

NC

Make check payable to:

Mail order form and check to: Kentucky Department of Revenue

251 (flat rate)

$15.00

Kentucky State Treasurer

FORMS

P.O. Box 518

Over 251

$.05 each

Frankfort, Kentucky 40602-0518

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6