Form Dp-151 - Smokeless And Loose Tobacco Tax Return

ADVERTISEMENT

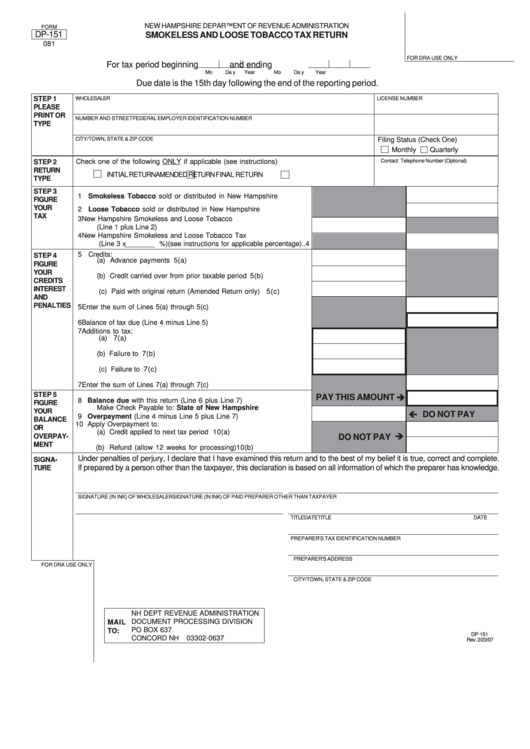

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

DP-151

SMOKELESS AND LOOSE TOBACCO TAX RETURN

081

FOR DRA USE ONLY

For tax period beginning

and ending

Mo

Da y

Year

Mo

Da y

Year

Due date is the 15th day following the end of the reporting period.

STEP 1

WHOLESALER

LICENSE NUMBER

PLEASE

PRINT OR

NUMBER AND STREET

FEDERAL EMPLOYER IDENTIFICATION NUMBER

TYPE

CITY/TOWN, STATE & ZIP CODE

Filing Status (Check One)

Monthly

Quarterly

Check one of the following ONLY if applicable (see instructions)

STEP 2

Contact Telephone Number (Optional)

RETURN

INITIAL RETURN

AMENDED RETURN

FINAL RETURN

TYPE

STEP 3

1 Smokeless Tobacco sold or distributed in New Hampshire .................

1

FIGURE

YOUR

2 Loose Tobacco sold or distributed in New Hampshire ...........................

2

TAX

3 New Hampshire Smokeless and Loose Tobacco

(Line 1 plus Line 2) ............................................................................... 3

4 New Hampshire Smokeless and Loose Tobacco Tax

(Line 3 x

%)(see instructions for applicable percentage) ..

4

5 Credits:

STEP 4

(a) Advance payments ........................................................................ 5(a)

FIGURE

YOUR

(b) Credit carried over from prior taxable period ................................ 5(b)

CREDITS

INTEREST

(c) Paid with original return (Amended Return only) .......................... 5(c)

AND

PENALTIES

5

Enter the sum of Lines 5(a) through 5(c) .................................................

5

6 Balance of tax due (Line 4 minus Line 5) .................................................

6

7 Additions to tax:

(a) Interest ........................................................................................... 7(a)

(b) Failure to Pay .................................................................................. 7(b)

(c) Failure to File .................................................................................. 7(c)

7 Enter the sum of Lines 7(a) through 7(c) .................................................

7

STEP 5

PAY THIS AMOUNT

8 Balance due with this return (Line 6 plus Line 7) ...................................

8

FIGURE

Make Check Payable to: State of New Hampshire

YOUR

DO NOT PAY

9 Overpayment (Line 4 minus Line 5 plus Line 7) .....................................

9

BALANCE

10 Apply Overpayment to:

OR

(a) Credit applied to next tax period ...................................................

10(a)

OVERPAY-

DO NOT PAY

MENT

(b) Refund (allow 12 weeks for processing) ....................................

10(b)

Under penalties of perjury, I declare that I have examined this return and to the best of my belief it is true, correct and complete.

SIGNA-

TURE

If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.

SIGNATURE (IN INK) OF WHOLESALER

SIGNATURE (IN INK) OF PAID PREPARER OTHER THAN TAXPAYER

TITLE

DATE

TITLE

DATE

PREPARER'S TAX IDENTIFICATION NUMBER

PREPARER'S ADDRESS

FOR DRA USE ONLY

CITY/TOWN, STATE & ZIP CODE

NH DEPT REVENUE ADMINISTRATION

DOCUMENT PROCESSING DIVISION

MAIL

PO BOX 637

TO:

DP-151

CONCORD NH

03302-0637

Rev. 2/23/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2