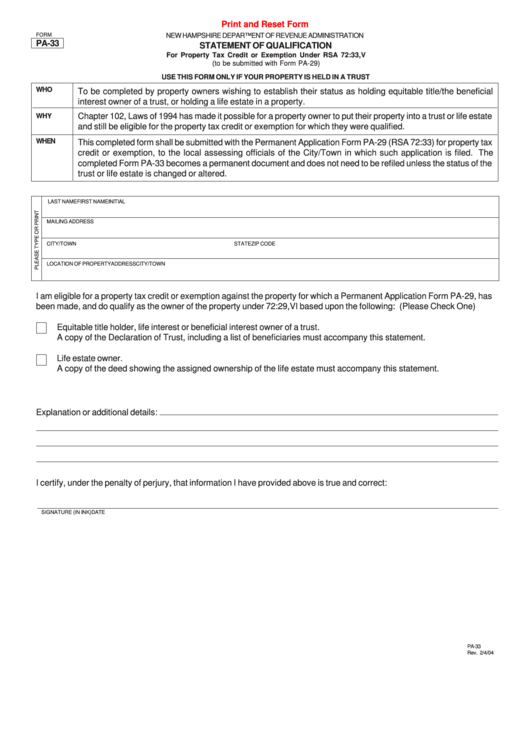

Print and Reset Form

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

PA-33

STATEMENT OF QUALIFICATION

For Property Tax Credit or Exemption Under RSA 72:33,V

(to be submitted with Form PA-29)

USE THIS FORM ONLY IF YOUR PROPERTY IS HELD IN A TRUST

WHO

To be completed by property owners wishing to establish their status as holding equitable title/the beneficial

interest owner of a trust, or holding a life estate in a property.

WHY

Chapter 102, Laws of 1994 has made it possible for a property owner to put their property into a trust or life estate

and still be eligible for the property tax credit or exemption for which they were qualified.

WHEN

This completed form shall be submitted with the Permanent Application Form PA-29 (RSA 72:33) for property tax

credit or exemption, to the local assessing officials of the City/Town in which such application is filed. The

completed Form PA-33 becomes a permanent document and does not need to be refiled unless the status of the

trust or life estate is changed or altered.

LAST NAME

FIRST NAME

INITIAL

MAILING ADDRESS

CITY/TOWN

STATE

ZIP CODE

LOCATION OF PROPERTY

ADDRESS

CITY/TOWN

I am eligible for a property tax credit or exemption against the property for which a Permanent Application Form PA-29, has

been made, and do qualify as the owner of the property under 72:29,VI based upon the following: (Please Check One)

Equitable title holder, life interest or beneficial interest owner of a trust.

A copy of the Declaration of Trust, including a list of beneficiaries must accompany this statement.

Life estate owner.

A copy of the deed showing the assigned ownership of the life estate must accompany this statement.

Explanation or additional details:

I certify, under the penalty of perjury, that information I have provided above is true and correct:

SIGNATURE (IN INK)

DATE

PA-33

Rev. 2/4/04

1

1