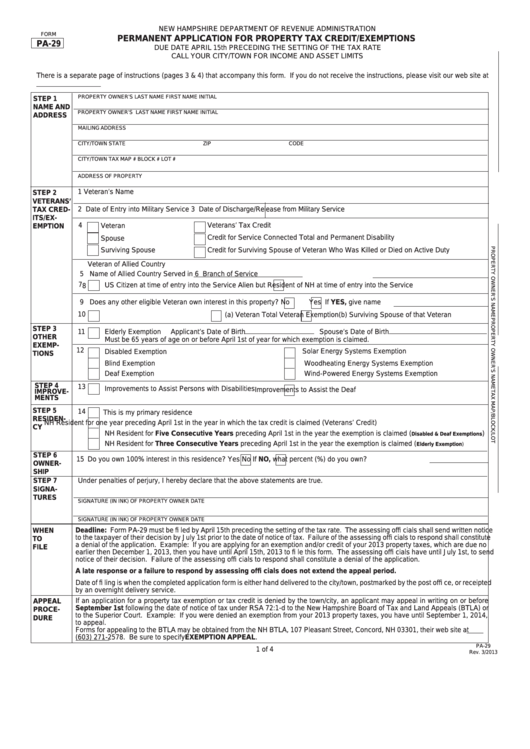

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

PERMANENT APPLICATION FOR PROPERTY TAX CREDIT/EXEMPTIONS

PA-29

DUE DATE APRIL 15th PRECEDING THE SETTING OF THE TAX RATE

CALL YOUR CITY/TOWN FOR INCOME AND ASSET LIMITS

There is a separate page of instructions (pages 3 & 4) that accompany this form. If you do not receive the instructions, please visit our web site at

or contact your city/town.

PROPERTY OWNER’S LAST NAME

FIRST NAME

INITIAL

STEP 1

NAME AND

PROPERTY OWNER’S LAST NAME

FIRST NAME

INITIAL

ADDRESS

MAILING ADDRESS

CITY/TOWN

STATE

ZIP CODE

CITY/TOWN TAX MAP #

BLOCK #

LOT #

ADDRESS OF PROPERTY

1 Veteran’s Name

STEP 2

VETERANS’

TAX CRED-

2 Date of Entry into Military Service

3 Date of Discharge/Release from Military Service

ITS/EX-

4

Veterans’ Tax Credit

Veteran

EMPTION

Credit for Service Connected Total and Permanent Disability

Spouse

Surviving Spouse

Credit for Surviving Spouse of Veteran Who Was Killed or Died on Active Duty

Veteran of Allied Country

5 Name of Allied Country Served in

6 Branch of Service

7

US Citizen at time of entry into the Service

Alien but Resident of NH at time of entry into the Service

8

9 Does any other eligible Veteran own interest in this property?

No

Yes If YES, give name

10

Total Veteran Exemption

(a) Veteran

(b) Surviving Spouse of that Veteran

STEP 3

11

Elderly Exemption

Applicant’s Date of Birth

Spouse’s Date of Birth

OTHER

Must be 65 years of age on or before April 1st of year for which exemption is claimed.

EXEMP-

12

Disabled Exemption

Solar Energy Systems Exemption

TIONS

Blind Exemption

Woodheating Energy Systems Exemption

Deaf Exemption

Wind-Powered Energy Systems Exemption

STEP 4

13

Improvements to Assist Persons with Disabilities

Improvements to Assist the Deaf

IMPROVE-

MENTS

STEP 5

14

This is my primary residence

RESIDEN-

NH Resident for one year preceding April 1st in the year in which the tax credit is claimed (Veterans’ Credit)

CY

NH Resident for Five Consecutive Years preceding April 1st in the year the exemption is claimed (

)

Disabled & Deaf Exemptions

NH Resident for Three Consecutive Years preceding April 1st in the year the exemption is claimed (

Elderly Exemption)

STEP 6

15

Do you own 100% interest in this residence?

Yes

No

If NO, what percent (%) do you own?

OWNER-

SHIP

STEP 7

Under penalties of perjury, I hereby declare that the above statements are true.

SIGNA-

TURES

SIGNATURE (IN INK) OF PROPERTY OWNER

DATE

SIGNATURE (IN INK) OF PROPERTY OWNER

DATE

Deadline: Form PA-29 must be fi led by April 15th preceding the setting of the tax rate. The assessing offi cials shall send written notice

WHEN

to the taxpayer of their decision by July 1st prior to the date of notice of tax. Failure of the assessing offi cials to respond shall constitute

TO

a denial of the application. Example: If you are applying for an exemption and/or credit of your 2013 property taxes, which are due no

FILE

earlier then December 1, 2013, then you have until April 15th, 2013 to fi le this form. The assessing offi cials have until July 1st, to send

notice of their decision. Failure of the assessing offi cials to respond shall constitute a denial of the application.

A late response or a failure to respond by assessing offi cials does not extend the appeal period.

Date of fi ling is when the completed application form is either hand delivered to the city/town, postmarked by the post offi ce, or receipted

by an overnight delivery service.

If an application for a property tax exemption or tax credit is denied by the town/city, an applicant may appeal in writing on or before

APPEAL

September 1st following the date of notice of tax under RSA 72:1-d to the New Hampshire Board of Tax and Land Appeals (BTLA) or

PROCE-

to the Superior Court. Example: If you were denied an exemption from your 2013 property taxes, you have until September 1, 2014,

DURE

to appeal.

Forms for appealing to the BTLA may be obtained from the NH BTLA, 107 Pleasant Street, Concord, NH 03301, their web site at www.

nh.gov/btla or by calling (603) 271-2578. Be sure to specify EXEMPTION APPEAL.

PA-29

1 of 4

Rev. 3/2013

1

1 2

2 3

3 4

4