Business And Occupation Tax Return Form - City Of Issaquah

ADVERTISEMENT

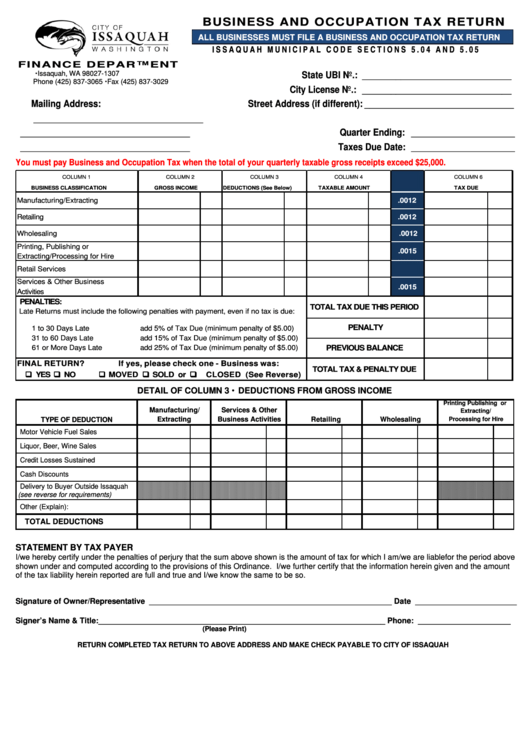

BUSINESS AND OCCUPATION TAX RETURN

ALL BUSINESSES MUST FILE A BUSINESS AND OCCUPATION TAX RETURN

I S S A Q U A H M U N I C I P A L C O D E S E C T I O N S 5 . 0 4 A N D 5 . 0 5

F I N A NC E DE PA R T M E N T

P.O. Box 1307 Issaquah, WA 98027-1307

State UBI No.: _______________________________

Phone (425) 837-3065 Fax (425) 837-3029

City License No.: _______________________________

Issaquahwa.gov

Mailing Address:

Street Address (if different): _______________________________

____________________________________

____________________________________

Quarter Ending: ______________________

____________________________________

Taxes Due Date: ______________________

You must pay Business and Occupation Tax when the total of your quarterly taxable gross receipts exceed $25,000.

COLUMN 1

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 5

COLUMN 6

BUSINESS CLASSIFICATION

GROSS INCOME

DEDUCTIONS (See Below)

TAXABLE AMOUNT

RATE

TAX DUE

Manufacturing/Extracting

.0012

Retailing

.0012

Wholesaling

.0012

Printing, Publishing or

.0015

Extracting/Processing for Hire

Retail Services

.0015

Services & Other Business

.0015

Activities

PENALTIES:

TOTAL TAX DUE THIS PERIOD

Late Returns must include the follow ing penalties w ith payment, even if no tax is due:

PENALTY

1 to 30 Days Late

add 5% of Tax Due (minimum penalty of $5.00)

31 to 60 Days Late

add 15% of Tax Due (minimum penalty of $5.00)

61 or More Days Late

add 25% of Tax Due (minimum penalty of $5.00)

PREVIOUS BALANCE

FINAL RETURN?

If yes, please check one - Business was:

TOTAL TAX & PENALTY DUE

YES NO

MOVED SOLD or

CLOSED (See Reverse)

DETAIL OF COLUMN 3 DEDUCTIONS FROM GROSS INCOME

Printing Publishing or

Manufacturing/

Services & Other

Extracting/

Extracting

Business Activities

TYPE OF DEDUCTION

Retailing

Wholesaling

Processing for Hire

Motor Vehicle Fuel Sales

Liquor, Beer, Wine Sales

Credit Losses Sustained

Cash Discounts

Delivery to Buyer Outside Issaquah

(see reverse for requirements)

Other (Explain):

TOTAL DEDUCTIONS

STATEMENT BY TAX PAYER

I/we hereby certify under the penalties of perjury that the sum above shown is the amount of tax for which I am/we are liable for the period above

shown under and computed according to the provisions of this Ordinance. I/we further certify that the information herein given and the amount

of the tax liability herein reported are full and true and I/we know the same to be so.

Signature of Owner/Representative _______________________________________________________ Date _______________________

Signer’s Name & Title: _________________________________________________________________ Phone: _____________________

(Please Print)

RETURN COMPLETED TAX RETURN TO ABOVE ADDRESS AND MAKE CHECK PAYABLE TO CITY OF ISSAQUAH

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2