Form Wvuc-B-6-11 - Initial Claim/lowearnings Report - West Virginia Division Of Unemployment Compensation

ADVERTISEMENT

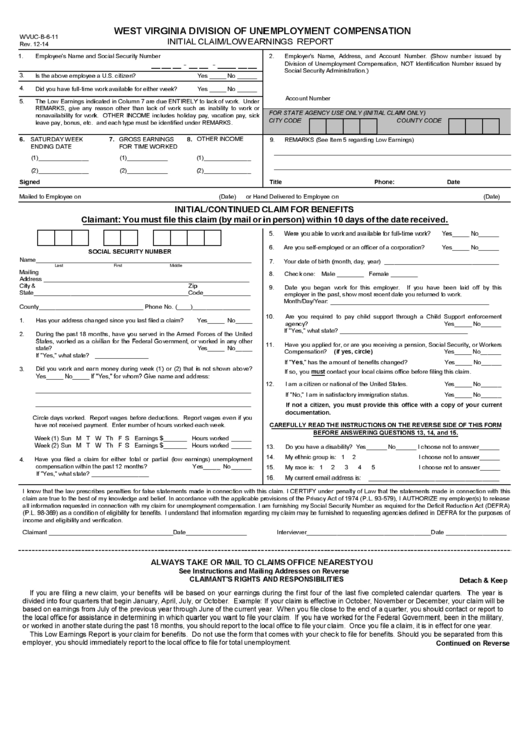

WEST VIRGINIA DIVISION OF UNEMPLOYMENT COMPENSATION

WVUC-B-6-11

INITIAL CLAIM/LOW EARNINGS REPORT

Rev. 12-14

1.

Employee's Name and Social Security Number

2.

Employer's Name, Address, and Account Number. (Show number issued by

Division of Unemployment Compensation, NOT Identification Number issued by

__ __ __

-

__ __

-

__ __ __ __

Social Security Administration.)

3.

Is the above employee a U.S. citizen?

Yes _____ No ______

4.

Did you have full-time work available for either week?

Yes _____ No ______

Account Number

The Low Earnings indicated in Column 7 are due ENTIRELY to lack of work. Under

5.

REMARKS, give any reason other than lack of work such as inability to work or

FOR STATE AGENCY USE ONLY (INITIAL CLAIM ONLY)

nonavailability for work. OTHER INCOME includes holiday pay, vacation pay, sick

CITY CODE

COUNTY CODE

leave pay, bonus, etc. and each type must be identified under REMARKS.

6.

SATURDAY WEEK

7.

8. OTHER INCOME

GROSS EARNINGS

9.

REMARKS (See Item 5 regarding Low Earnings)

ENDING DATE

FOR TIME WORKED

(1)_______________

(1)____________

(1)______________

(2)_______________

(2)____________

(2)______________

Signed

Title

Phone:

Date

Mailed to Employee on

(Date)

or Hand Delivered to Employee on

(Date)

INITIAL/CONTINUED CLAIM FOR BENEFITS

Claimant: You must file this claim (by mail or in person) within 10 days of the date received.

5.

Were you able to work and available for full-time work?

Yes_____ No______

6.

Are you self-employed or an officer of a corporation?

Yes_____ No______

SOCIAL SECURITY NUMBER

Name________________________________________________________________

7.

Your date of birth (month, day, year) __________________________________

Last

First

Middle

Mailing

8.

Check one: Male ________ Female ________

Address _____________________________________________________________

City &

Zip

9.

Date you began work for this employer. If you have been laid off by this

State______________________________________________Code______________

employer in the past, show most recent date you returned to work.

Month/Day/Year: _______________________________________________

County_______________________________ Phone No. (____)_________________

10.

Are you required to pay child support through a Child Support enforcement

1.

Has your address changed since you last filed a claim?

Yes_____ No_____

agency?

Yes_____ No______

If "Yes," what state? ______________________________________

During the past 18 months, have you served in the Armed Forces of the United

2.

States, worked as a civilian for the Federal Government, or worked in any other

11.

Have you applied for, or are you receiving a pension, Social Security, or Workers

state?

Yes_____ No_____

Compensation? (if yes, circle)

Yes_____ No______

If "Yes," what state? ________________

If " Yes ," has the amount of benefits changed?

Yes_____ No______

3.

Did you work and earn money during week (1) or (2) that is not shown above?

If so, you must contact your local claims office before filing this claim.

Yes_____ No_____ If "Yes," for whom? Give name and address:

12.

I am a citizen or national of the United States.

Yes_____ No______

________________________________________________________________

If "No," I am in satisfactory immigration status.

Yes_____ No______

________________________________________________________________

If not a citizen, you must provide this office with a copy of your current

documentation.

Circle days worked. Report wages before deductions. Report wages even if you

have not received payment. Enter number of hours worked each week.

CAREFULLY READ THE INSTRUCTIONS ON THE REVERSE SIDE OF THIS FORM

BEFORE ANSWERING QUESTIONS 13, 14, and 15.

Week (1) Sun M T W Th F S Earnings $_______ Hours worked ______

Week (2) Sun M T W Th F S Earnings $_______ Hours worked ______

13.

Do you have a disability? Yes______ No______ I choose not to answer______

14.

My ethnic group is: 1 2

I choose not to answer______

Have you filed a claim for either total or partial (low earnings) unemployment

4.

compensation within the past 12 months?

Yes_____ No______

15.

My race is: 1 2

3

4

5

I choose not to answer______

If "Yes," what state? _________________

16.

My current email address is: _______________________________________

I know that the law prescribes penalties for false statements made in connection with this claim. I CERTIFY under penalty of Law that the statements made in connection with this

claim are true to the best of my knowledge and belief. In accordance with the applicable provisions of the Privacy Act of 1974 (P.L. 93-579), I AUTHORIZE my employer(s) to release

all information requested in connection with my claim for unemployment compensation. I am furnishing my Social Security Number as required for the Deficit Reduction Act (DEFRA)

(P.L. 98-369) as a condition of eligibility for benefits. I understand that information regarding my claim may be furnished to requesting agencies defined in DEFRA for the purposes of

income and eligibility and verification.

Claimant _____________________________________Date__________________

Interviewer_____________________________________Date __________________

ALWAYS TAKE OR MAIL TO CLAIMS OFFICE NEARESTYOU

See Instructions and Mailing Addresses on Reverse

CLAIMANT'S RIGHTS AND RESPONSIBILITIES

Detach & Keep

If you are filing a new claim, your benefits will be based on your earnings during the first four of the last five completed calendar quarters. The year is

divided into four quarters that begin January, April, July, or October. Example: If your claim is effective in October, November or December, your claim will be

based on earnings from July of the previous year through June of the current year. When you file close to the end of a quarter, you should contact or report to

the local office for assistance in determining in which quarter you want to file your claim. If you have worked for the Federal Government, been in the military,

or worked in another state during the past 18 months, you should report to the local office to file your claim. Once you file a claim, it is in effect for one year.

This Low Earnings Report is your claim for benefits. Do not use the form that comes with your check to file for benefits. Should you be separated from this

employer, you should immediately report to the local office to file for total unemployment.

Continued on Reverse

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1