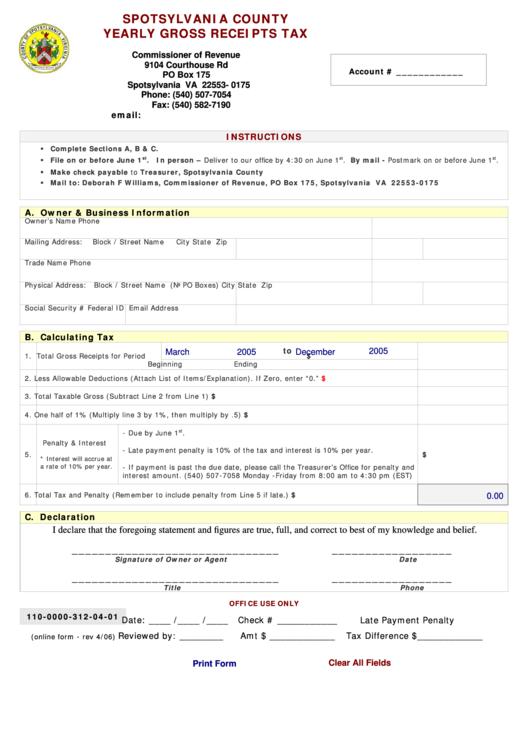

SPOTSYLVANIA COUNTY

YEARLY GROSS RECEIPTS TAX

Commissioner of Revenue

9104 Courthouse Rd

Account # ____________

PO Box 175

Spotsylvania VA 22553- 0175

Phone: (540) 507-7054

Fax: (540) 582-7190

email: cor@spotsylvania.va.us

INSTRUCTIONS

Complete Sections A, B & C.

st

st

st

File on or before June 1

. In person – Deliver to our office by 4:30 on June 1

. By mail - Postmark on or before June 1

.

Make check payable to Treasurer, Spotsylvania County

Mail to: Deborah F Williams, Commissioner of Revenue, PO Box 175, Spotsylvania VA 22553-0175

A. Owner & Business Information

Owner’s Name

Phone

Mailing Address:

Block / Street Name

City

State

Zip

Trade Name

Phone

Physical Address:

Block / Street Name (No PO Boxes)

City

State

Zip

Social Security #

Federal ID

Email Address

B. Calculating Tax

to

2005

March

2005

December

1.

Total Gross Receipts for Period

$

Beginning

Ending

2.

Less Allowable Deductions (Attach List of Items/Explanation). If Zero, enter “0.”

$

3.

Total Taxable Gross (Subtract Line 2 from Line 1)

$

4.

One half of 1% (Multiply line 3 by 1%, then multiply by .5)

$

st

- Due by June 1

.

Penalty & Interest

- Late payment penalty is 10% of the tax and interest is 10% per year.

5.

$

* Interest will accrue at

a rate of 10% per year.

- If payment is past the due date, please call the Treasurer’s Office for penalty and

interest amount. (540) 507-7058 Monday -Friday from 8:00 am to 4:30 pm (EST)

6.

Total Tax and Penalty (Remember to include penalty from Line 5 if late.)

$

0.00

C. Declaration

I declare that the foregoing statement and figures are true, full, and correct to best of my knowledge and belief.

_______________________________

__________________

Signature of Owner or Agent

Date

_______________________________

__________________

Title

Phone

OFFICE USE ONLY

110-0000-312-04-01

Date: ____ /____ /____

Check # ___________

Late Payment Penalty

Reviewed by: ________

Amt $ ____________

Tax Difference $____________

(online form - rev 4/06)

Clear All Fields

Print Form

1

1