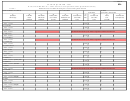

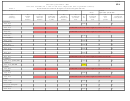

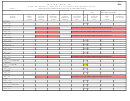

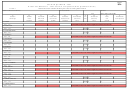

Form 85a - Kansas Schedule 1 - Ifta Fuel Tax Computation (Ifta Qualified Vehicles) - 2007 Page 2

ADVERTISEMENT

FORM

85A

SECOND QUARTER - 2007

KANSAS SCHEDULE 1 - IFTA Fuel Tax Computation (IFTA Qualified Vehicles)

PAGE 2

Round amounts in Columns B through F to nearest whole gallon and mile

NAME AS SHOWN ON FORM 85

IFTA License Number

Tax Period

A55

April 1, 2007 - June 30, 2007

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

(J)

Jurisdiction

Total Miles

Total Taxable

Taxable Gallons

Total Gallons

Net Taxable Gals

Tax

Tax Due/Credit

Interest

Total Due/Credit

and Fuel Type

in each

Miles in each

(Col. C divided

Purchased in each

(Col. D minus

Rate

(Col. F times

at 1%

(Col. H plus Col. I)

Jurisdiction

Jurisdiction

by AMG )

Jurisdiction

Col. E)

Col. G)

per month

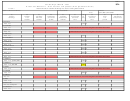

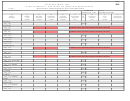

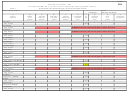

21 MAINE

22011 A55

No A55 fuel use tax, enter miles and gallons to balance with form 85

18 MARYLAND

.2425 $

$

$

19011

A55

19 MASSACHUSETTS

.2100 $

$

$

20011 A55

20 MICHIGAN

No A55 fuel use tax, enter miles and gallons to balance with form 85

21011 A55

22 MINNESOTA

.2000 $

$

$

23011 A55

23 MISSISSIPPI

.1800 $

$

$

24011 A55

24 MISSOURI

.1700 $

$

$

25011 A55

25 MONTANA

No A55 fuel use tax, enter miles and gallons to balance with form 85

26011 A55

26 NEBRASKA

.2710

27011 A55

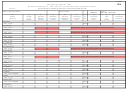

27 NEVADA

.1900 $

$

$

28011

A55

28 NEW HAMPSHIRE

29011 A55

No A55 fuel use tax, enter miles and gallons to balance with form 85

29 NEW JERSEY

30011 A55

No A55 fuel use tax, enter miles and gallons to balance with form 85

30 NEW MEXICO

31011

A55

No A55 fuel use tax, enter miles and gallons to balance with form 85

31 NEW YORK

.3860 $

$

$

32011 A55

32 NORTH CAROLINA

.2990 $

$

$

33011

A55

33 NORTH DAKOTA

34011

A55

No A55 fuel use tax, enter miles and gallons to balance with form 85

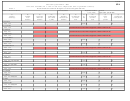

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5