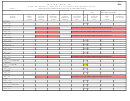

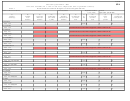

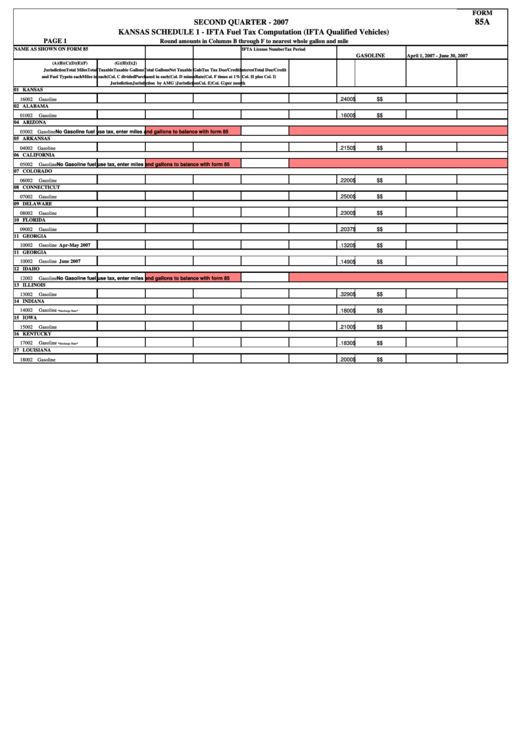

Form 85a - Kansas Schedule 1 - Ifta Fuel Tax Computation (Ifta Qualified Vehicles) - 2007

ADVERTISEMENT

FORM

85A

SECOND QUARTER - 2007

KANSAS SCHEDULE 1 - IFTA Fuel Tax Computation (IFTA Qualified Vehicles)

PAGE 1

Round amounts in Columns B through F to nearest whole gallon and mile

NAME AS SHOWN ON FORM 85

IFTA License Number

Tax Period

GASOLINE

April 1, 2007 - June 30, 2007

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

(J)

Jurisdiction

Total Miles

Total Taxable

Taxable Gallons

Total Gallons

Net Taxable Gals

Tax

Tax Due/Credit

Interest

Total Due/Credit

and Fuel Type

in each

Miles in each

(Col. C divided

Purchased in each

(Col. D minus

Rate

(Col. F times

at 1%

(Col. H plus Col. I)

Jurisdiction

Jurisdiction

by AMG )

Jurisdiction

Col. E)

Col. G)

per month

01 KANSAS

.2400 $

$

$

16002

Gasoline

02 ALABAMA

.1600 $

$

$

01002

Gasoline

04 ARIZONA

03002 Gasoline

No Gasoline fuel use tax, enter miles and gallons to balance with form 85

05 ARKANSAS

.2150 $

$

$

04002 Gasoline

06 CALIFORNIA

05002

Gasoline

No Gasoline fuel use tax, enter miles and gallons to balance with form 85

07 COLORADO

.2200 $

$

$

06002

Gasoline

08 CONNECTICUT

.2500 $

$

$

07002

Gasoline

09 DELAWARE

.2300 $

$

$

08002

Gasoline

10 FLORIDA

.2037 $

$

$

09002

Gasoline

11 GEORGIA

10002

Gasoline Apr-May 2007

.1320 $

$

$

11 GEORGIA

10002

Gasoline June 2007

.1490 $

$

$

12 IDAHO

12002

Gasoline

No Gasoline fuel use tax, enter miles and gallons to balance with form 85

13 ILLINOIS

.3290 $

$

$

13002

Gasoline

14 INDIANA

14002

Gasoline

.1800 $

$

$

*Surcharge State*

15 IOWA

.2100 $

$

$

15002

Gasoline

16 KENTUCKY

17002

Gasoline

.1830 $

$

$

*Surcharge State*

17 LOUISIANA

.2000 $

$

$

18002 Gasoline

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

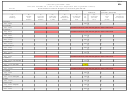

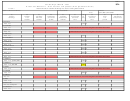

1

1 2

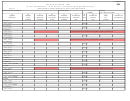

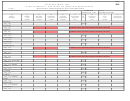

2 3

3 4

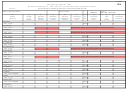

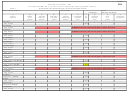

4 5

5