Form Pt-106.1/201.1 - Retailers Of Heating Oil Only - Receipts And Sales Form

ADVERTISEMENT

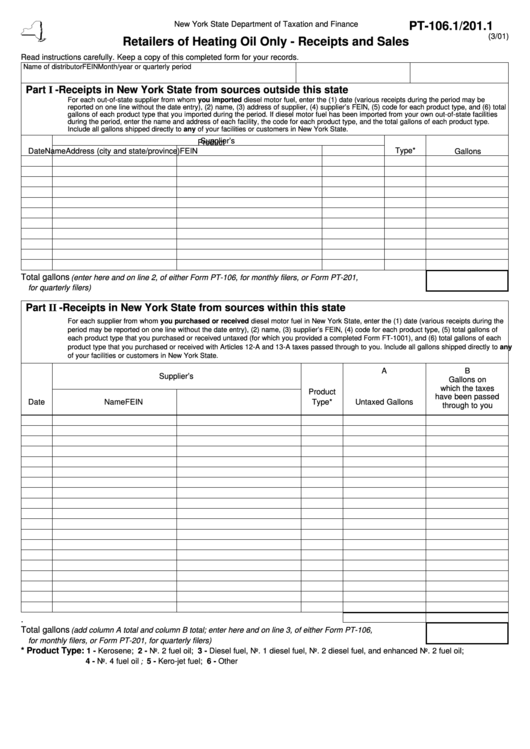

New York State Department of Taxation and Finance

PT-106.1/201.1

(3/01)

Retailers of Heating Oil Only - Receipts and Sales

Read instructions carefully. Keep a copy of this completed form for your records.

Name of distributor

FEIN

Month/year or quarterly period

Part I - Receipts in New York State from sources outside this state

For each out-of-state supplier from whom you imported diesel motor fuel, enter the (1) date (various receipts during the period may be

reported on one line without the date entry), (2) name, (3) address of supplier, (4) supplier’s FEIN, (5) code for each product type, and (6) total

gallons of each product type that you imported during the period. If diesel motor fuel has been imported from your own out-of-state facilities

during the period, enter the name and address of each facility, the code for each product type, and the total gallons of each product type.

Include all gallons shipped directly to any of your facilities or customers in New York State.

Supplier’s

Product

Type*

Date

Name

Address (city and state/province)

FEIN

Gallons

Total gallons

(enter here and on line 2, of either Form PT-106, for monthly filers, or Form PT-201,

for quarterly filers)

......................................................................................................................................

Part II - Receipts in New York State from sources within this state

For each supplier from whom you purchased or received diesel motor fuel in New York State, enter the (1) date (various receipts during the

period may be reported on one line without the date entry), (2) name, (3) supplier’s FEIN, (4) code for each product type, (5) total gallons of

each product type that you purchased or received untaxed (for which you provided a completed Form FT-1001), and (6) total gallons of each

product type that you purchased or received with Articles 12-A and 13-A taxes passed through to you. Include all gallons shipped directly to any

of your facilities or customers in New York State.

A

B

Supplier’s

Gallons on

which the taxes

Product

have been passed

Date

Name

FEIN

Type*

Untaxed Gallons

through to you

Total ...........................................................................................................................

Total gallons

(add column A total and column B total; enter here and on line 3, of either Form PT-106,

....................................................................................

for monthly filers, or Form PT-201, for quarterly filers)

* Product Type:

1 - Kerosene; 2 - No. 2 fuel oil; 3 - Diesel fuel, No. 1 diesel fuel, No. 2 diesel fuel, and enhanced No. 2 fuel oil;

4 - No. 4 fuel oil

5 - Kero-jet fuel; 6 - Other

;

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2